Talking about Venezuela is tantamount of talking about oil. This country, almost twice the size of Spain, has the largest amount of (heavy) crude oil reserves in the world, which grew strongly since 2011. It may be unfair and/or paradoxical that all this underground wealth is present at the worst time for the country, which is facing its worst internal economic crisis to date.

The hyperinflation that the country suffers, which reaches levels above 2600%, afected by the shortage of basic necessities, continues to leave its mark on the Venezuelan economy, which ends up translating, as we will see throughout this article, into a significant drop in the share of Venezuelan crude oil production.

The importance of oil for Venezuela

Far away lies 2008, when the Bolivarian Republic of Venezuela had almost reached 3.5 million barrels per day (mbpd) of oil production. A high price of crude gave oxygen to accounts that were largely nourished by the wealth generated through oil exports to other countries, such as the USA and China.

In 2014 the darkness came, as the market was in a state of oversupply and the main objective of the Organization of the Petroleum Exporting Countries (OPEC) was to try and stop the North American fracking. As a result, the market was plunged into a price war that resulted in oil prices close to $USD 28/bbl.

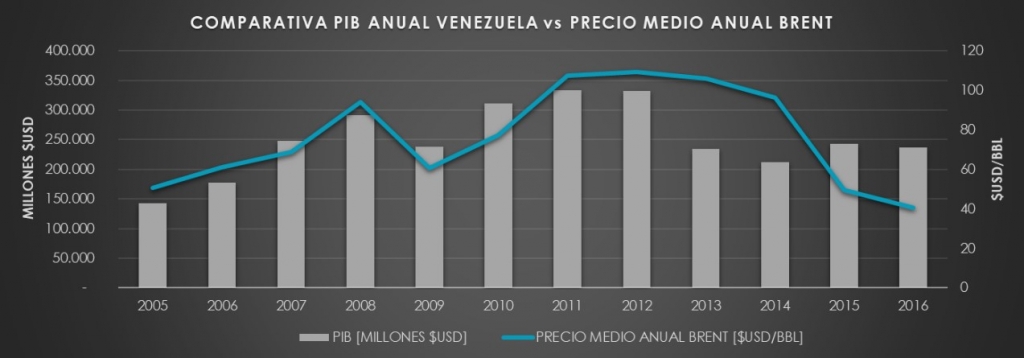

For countries with such a sharp linear correlation between the GDP and oil price, such as Venezuela, this meant that their wealth was significantly reduced in the face of the falls in the price of crude oil. In fact, its GDP decreased by 36% in 2014 compared to 2012 levels.

Reasons for the Venezuelan debacle

Hard times came for most “petro-countries”. In Venezuela, 96% of GDP was obtained from oil transactions due to the lack of diversification in its economy. With oil prices falling since 2014, the country’s wealth had declined.

Venezuela produces extra heavy crude oil in the Orincoco Oil Belt area and, in order to market it, it relies significantly on the importation of diluents that allow it to lighten this heavy oil. With the current economic situation, the production cycle is being tightened, since the national oil company – PDVSA (Petróleos de Venezuela) – has had difficulties in importing the necessary products that allow it to commercialize its crude oil.

This in turn led to a significant drop in the country’s oil production, which has been in free fall since the beginning of 2014, reaching official production quotas of 1.56 million bpd in March. After years of decreasing trends, Venezuelan crude oil production is projected to fall to 1.38 million bpd by the end of 2018, according to the IEA.

In addition to the drop in production, refineries in the United States and Asia have reported problems with the quality of crude oil imported from Venezuela, resulting in requests for discounts or the termination of purchasing agreements.

Can Venezuela change this situation?

We are talking about a country that has no diversity in its economy, given that almost all its revenue is generated through oil sales. In addition, their economic situation is in a coma, which does not help to encourage new investments.

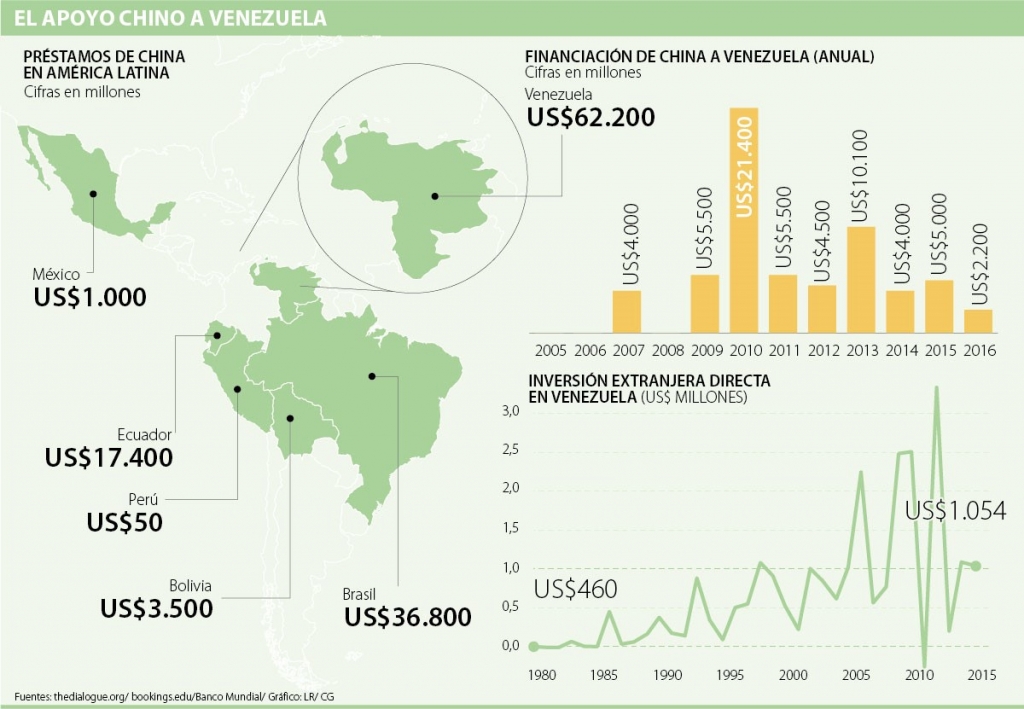

The only short-term solution is external financing, which has already been provided to date. So far, Venezuela has received 44% of Chinese funding in Latin America which, from 2005 to 2016, amounts to more than $62 billion, of which it owes approximately 40%.

The agreement between Venezuela and China is based on “mutually advantageous” exchanges. The China Development Bank provides credit lines to Venezuelans, provided they consume Chinese goods and services. Once they use the credit lines, Venezuelans can pay their suppliers by means of oil shipments (billed at significant discounts), which are subtracted from the country’s debit balance.

Therefore, Venezuela finds itself in a dead end, investing its financing in the same place where it comes from, obviously paying it with interest, but it is also liquidated with the main ace of its economy, which is going through so many difficulties, almost free of charge.

What has been its effect on the price of oil?

On November 30, 2016, OPEC and other countries such as Russia signed an agreement to cut their domestic oil production to eliminate excess supply in the market.

Largely due to the Venezuelan situation, OPEC recorded its lowest production quota of the last 11 months in March 2018 at 32.14 million bpd, 590 thousand bpd below the limit set in the agreement (32.73 million bpd).

Thanks to the excessive commitment of Saudi Arabia, the declines of Libya or Angola, but above all to the situation in Venezuela, OPEC has been able to reach 140% commitment of the predicted cut quota. This effect has had an impact on the price of oil, as it currently stands at prices above $USD 70/bbl (if we take the Brent oil rate as a reference), having increased by more than 55% since the beginning of the agreement.

This situation of overcutting could be good news for other producers, as they could take advantage of a higher market share without affecting the price of crude oil. In fact, one of the main winners of this situation is the United States. The Americans continue to show their current productive thrust with 808 shale platforms (levels not seen since March 2015) and a current production quota of 10.46 billion bpd.

On the other hand, based on the EIA forecasts for 2018, global supply is expected to increase by 1.8 million bpd, 0.4 million bpd above the growth in demand this year. Now, do these forecasts fit the reality of the moment? As we have seen throughout this article, Venezuelan expectations are not positive, and their share is declining month after month, so it is very likely that the decline will continue…

Will it be so abrupt as to take oil well above current levels?

Adrián Gil | Energy Consultant

If you found it interesting, please share it!

Recent Articles