In the era of energy transition and the relentless search for sustainable alternatives, biogas and biomethane emerge as promising options to reduce greenhouse gas emissions, moving us towards a low-carbon economy. In this context, it is imperative that we look at the biogas/biomethane market in European countries and thoroughly understand the relevance of selling their guarantees of origin and sustainability testing.

Biogas and biomethane are two types of gases produced from the digestion of organic matter, usually biodegradable waste such as agricultural waste, manure, sewage sludge, food waste and biomass. Biogas is a mixture of gases composed mainly of methane (CH4) and carbon dioxide (CO2), together with traces of other components such as water vapour, hydrogen sulphide and nitrogen. It is used as a renewable energy source for electricity generation, heating and cooling, as well as a fuel for vehicles and industrial applications.

Biomethane is a purified and enriched form of biogas with a high methane content (usually more than 95%) and very low content of other components, especially CO2. It is used in a similar way to conventional natural gas and is injected into existing gas networks. It can be used for heating, cooking, electricity generation and as a fuel for vehicles with compressed natural gas (CNG) or liquefied natural gas (LNG) technology. It is a renewable energy source and a sustainable alternative to fossil natural gas.

For companies committed to becoming Net-Zero, procuring biogas and biomethane, as well as their guarantees of origin and/or proof of sustainability, is an effective strategy to demonstrate their commitment to renewable energy procurement.

Influence of regulation on biogas and biomethane development

We cannot ignore the fact that the development of the biogas and biomethane market goes hand in hand with political support through European regulations which are then transferred to the state level. However, the demand for these resources will be influenced by factors as varied as gas prices, economic growth, geopolitical interests and climate objectives.

According to the guidelines of the EU’s “Target 55” package, the role of biogas, biomethane, and other renewable gases will inevitably grow in the coming decades. However, this development will manifest itself heterogeneously in each country; those that accompany their policies with economic incentives will experience greater development, as has been the case in Germany, France and the United Kingdom, until now leaders in the adoption of biogas and biomethane through the “feed-in tariff” system, whereby the state guarantees the purchase of the biogas and/or biomethane produced, also establishing the price of the guarantees of origin. Germany has one of the largest biogas plants in Europe, the Grotzenburg project, which uses organic waste and sewage sludge to generate electricity that is then fed into the grid.

Below is an illustration of the possible distribution of biomethane and biogas production plants by 2030:

Figure 1: Biomethane and biogas potential in 2030 by technology and country

Source: (European Biogas Association)

In Figure 1, the expected growth of biogas production can be seen, with notable variations by country given that, but with variations, each country has the autonomy to define its path towards the energy transition and its climate commitments.

The intrinsic value of biogas and biomethane lies in their production from renewable sources, such as organic waste. This is the cornerstone of the decarbonisation strategy. Their true potential lies in “carbon removal and sequestration”.

Guarantees of origin and proof of sustainability

At the European level, there are currently two schemes for demonstrating the consumption of renewable gases: the regulatory scheme and the voluntary scheme.

The regulatory scheme is based on legislation such as the Renewable Energy Directive (RED II), which requires the transport industry to use at least 3.5% biogas in its fuel consumption. To ensure compliance with RED II, the transport sector makes use of sustainability test certificates. These certificates are issued by bodies such as the ISCC, which is endorsed by the European Union and has the authority to carry out audits to ensure that biogas and/or biomethane comply with the environmental criteria set by the European regulation (RED II).

As an EU-wide harmonised standard, these certificates are valid throughout the European Union, as they all follow the same environmental criteria. This means that the certificates can be used throughout the EU without having to comply with different requirements in each country, which facilitates trade and compliance across the region. In addition, these schemes guarantee a reduction of greenhouse gases, as stated in the standards of this certification.

On the other hand, the voluntary schemes are based on electronic certificates of guarantees of origin that accredit the renewable origin of the gas, allowing it to verify its origin and its contribution to sustainability. Importantly, guarantees of origin of renewable gas can have different origins such as biomass, biogas and biomethane (agricultural, urban, sewage treatment plants, forestry waste), and hydrogen.

Guarantees of origin and sustainability tests play a key role in ensuring transparency and trust in the biogas market. Furthermore, they are transactional between countries, provided the condition is met that the countries involved have a signed treaty that ensures that the environmental criteria for considering guarantees of origin are compatible. It should be noted that the regulation of guarantees of origin for renewable gas may vary according to the legislation of each country and may even limit their transaction.

It is important to mention that these two schemes represent two different markets with different prices. Regulated schemes have a higher price due to their higher environmental value, while in voluntary markets the certificates have a lower value, as they only guarantee the renewable origin of the gas. Furthermore, in European countries where the state procures biomethane and biogas, prices can also be regulated by the state, which adds a layer of price variability.

Below are some indicative market prices for certificates in 2023 at the European level and guarantees of origin, due to the impact of public funding on the price of the guarantee of origin, which has been differentiated in the graph:

Figure 2: Indicative prices for renewable gas certificates available in 2023

It should be noted that guarantees of origin offer biogas and biomethane producers a way to earn additional revenue to support their operations. The energy equivalence of a certificate is 1 MWh of biomethane and biogas.

The government of each biogas and biomethane-producing country establishes which body will manage the issuing of guarantees of origin. However, there are European platforms where a registration of the producer of guarantees of origin is made, but the competence over these is state-owned.

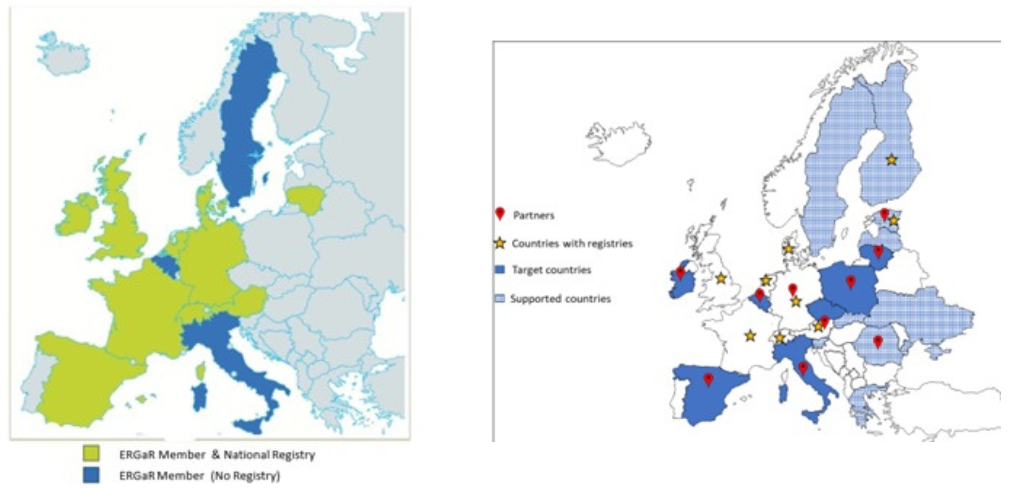

There are initiatives, such as the Renewable Gas Trade Centre in Europe (REGATRACE) platform, which aims to create an efficient trading system based on the issuing and trading of Guarantees of Origin for renewable gases. As well as Ergar, which is a platform for cooperation between national renewable gas registries in Europe that would enable the cross-border transfer of renewable gas certificates between member registries. Currently, the latter platform has 13 registered European countries:

Figure 3: European ERGAR-registered countries , European countries registered in REGATRACE

Source: ERGAR Source: REGATRACE

The complexity of the future of renewable gas certificates lies in member states developing the necessary digital infrastructure to operate with organisations and connect renewable gas certificates. Therefore, cooperation and alignment between schemes could improve efficiency in the transfer of renewable gas certificates across Europe and avoid multiple accounting of renewable value.

The biogas market in Europe will continue to evolve in the coming years as new policies and regulations are implemented. The sector is expected to continue to grow and the demand for biogas as a renewable energy source is expected to increase. However, some challenges need to be addressed, such as the harmonisation of policies and regulations between European countries and the creation of a single market for biogas. In addition, further progress in research and development of technologies to improve efficiency and reduce biogas production costs is essential. This is a major challenge as investments for the construction of biogas plants currently have a high economic value, and for some generators public funding or support for the purchase of biogas and/or biomethane is essential.

Claudia Bergnes |Decarbonization Consultant

If you found it interesting, please share it!

Recent Articles