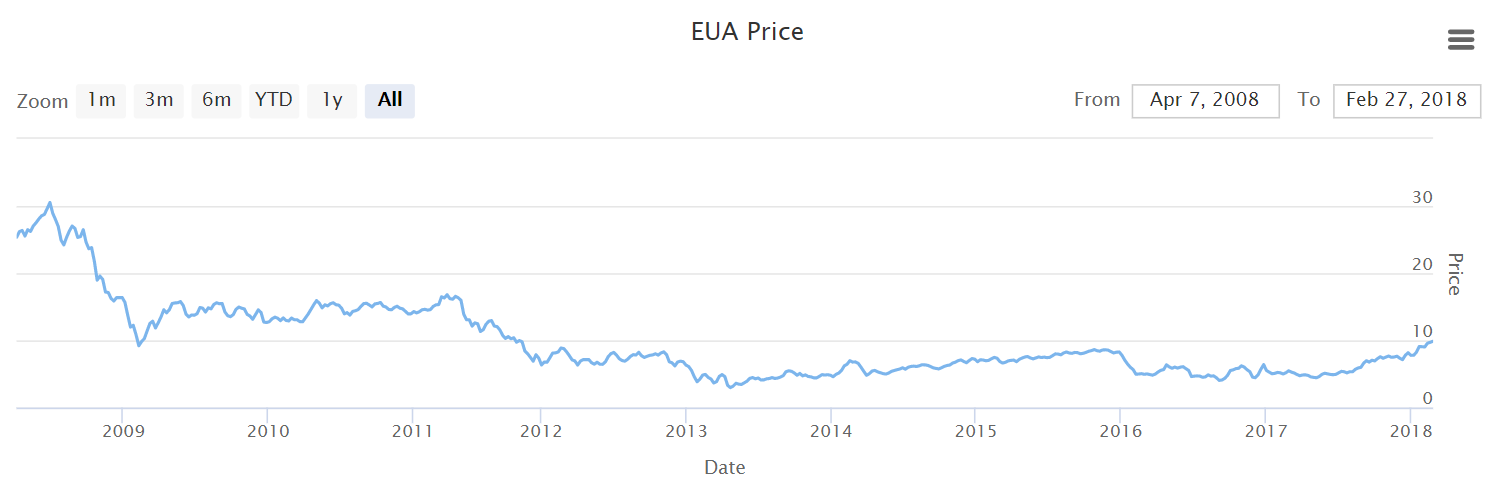

In February 27th the European Emission allowances (EUA) were traded above the 10 €/tone closing that day’s session at 10.21 €/tone, values not witnessed since 2012. The bullish trend initiated on the second half of 2017, when the EU started to address the future of the EU ETS market, was heavily felt in November after a reform proposal for this market, regarding the period after 2020, was provisionally endorsed by the Estonian presidency, the European Parliament and the Council. The reform was officially approved on February 27th marking a new Era for the EU ETS Market and for all the utilities companies that participate in the European energy mix towards a more sustainable future and closer to the level of ambition of the Paris Agreement.

Purpose of the EU ETS market

The EU Emissions Trading System (ETS) is the biggest reference of the cap and trade mechanisms to fight climate change and reduce greenhouse gas emissions. It currently operates in 31 countries (28 from the European Union along with Iceland, Norway and Lichtenstein). According to European Commission data, the EU ETS market covers more than 40% of the Greenhouse Gas Emissions (GHG) of the EU and imposes emission limits to more than 11 thousand heavy energy-using installations, such as, power stations and industrial plants.

The purpose of this system is to allow industries to trade emission permits in order to create a market where, higher CO2 emissions require purchasing while lower emissions give the opportunity to sell therefore, increasing the price of the allowances, encourages more investment in energy efficiency and environmental measures to reduce emissions, in an effort to sell, not buy, more bonds. However, the initial reality was totally the opposite: with the prices for these permits going incredibly low since 2012 (see Figure 1).

The problem is that the system has an oversupply of emission allowances in the market, creating a large gap between supply and demand, which consequently, lead to for low prices.

The ETS market is now ending the 3rd phase, that goes from 2013 to 2020, after passing the previous ones (2005-2012). The current phase has the following key drivers:

- Single EU-Wide Cap

The overall volume of Greenhouse Gases (GHG) covered by the EU ETS system is limited by a certain amount of emission allowances (cap) and, from 2013 this cap is being reduced each year by 1.74% corresponding to a reduction of 34.3 million allowances each year. The goal of this linear reduction is to avoid a surplus of bonds that can occur due to an improve in terms of energy efficiency and fuel shifts that will cut GHG emissions.

- Auctioning

Auctioning is the default system of the Emissions Trading System where the excess of the emissions is bought at a certain price, preferably high to encourage the investment in ways to reduce their local emissions. The goal of the 3rd phase is to reduce the amount of allocations free of charge and increase the number of permits that have to be auctioned. By the end of this third phase is expected that only 30% of the number of permits should be allocated free of auction.

Currently, 28 out of 31 countries include in the ETS market perform their auctions in a common platform in the European Energy Exchange (EEX), Germany and Poland also use an auction platform from EEX but independently. The United Kingdom has opted for using ICE to perform its auctions

- NER 300 programme

The NER 300 program is one of the biggest funding programmes for projects focused on low carbon energy innovation. This programme has been having a key role in the development of Carbon Capture and Storage (CCS) technologies and new approaches for renewable energy technologies on a commercial scale at European level.

The programme is divided into two areas, both managed by the European Investment Bank: one is called InnovFin Energy Demo Projects, which is responsible for financing projects for CCS, smart energy systems and storage, and another is the Connecting Europe Facility (CEF), which finances projects in the renewable and transport sectors.

The new reform

On November 22nd, a reform proposal for the EU ETS to be applied in the 4th phase (2020-2023) was provisionally accepted by the Estonian presidency and the EU Parliament, reform was finally voted and approved on the 27th of February.

With this new approach to the market, the ETS would be able to heavily contribute for a target of GHG emissions reduction by more than 40% by 2030, aligning goals with the Paris Agreement energy framework.

The revision of the ETS makes the system more ambitious and strict, when compared to the measures applied in the phase 3:

- Reduction in the volume of allowances

The cap for the volume of emissions allowances will be reduced every year at a pace of 2.2% against the old 1.74%. This will decrease significantly the number of allowances available accelerating the market tightening.

- Market Stability Reserve

The amount of allowances that can be allocated in the market stability reserve (MSR) will be temporarily doubled until 2023, but the validity of those allowances allocated in the MSR can be extinguished.

Before the recent reform of the ETS market, the emissions not allocated after the auctions were permanently retained in a way that could not be considered for the market surplus but also without being completed cancelled. This means that the Market Stability Reserve (MSR) was expected to growth each year keeping the unallocated carbon permits.

The new approach of the market includes now a limit on the size of the MSR which leads to a cancelation of some number of permits. The limit is the same value of the previous year’s auction volume, forcing the old permits to be extinct. Experts are optimistic with this new approach since they believe that, with the current pace of energy efficiency measures, the number of EUAs that will be unallocated will increase year after year, meaning that more permits will be cancelled also each year. This measure could accelerate the market equilibrium and push upwards the prices of the EUAs.

- Risk of carbon leakage

The new reform intends to protect the industry sector in terms of risk of carbon leakage and avoid cross-sectoral correction factor (CSCF) application by fitting the volumes of free allocations to the production levels of the companies.

Also, the share of allowances that will be allocated through auction was lowered to 57%, with a possible 3% more of reduction if the CSCF is applied.

The industry sectors that are more exposed to the possibility of relocating their production outside the European Union will receive all the emission permits for free and the sectors less exposed will have 30% share of free allocations, which will be gradually phased-out after 2026.

The new industries will count with the new entrants’ reserve (NER) that contains the unused allowances from the period of the 3rd phase (2013-2020) and 200 million more from the MSR.

Implications

A tightened market will logically make products made with fossil fuels, including power generation, more expensive. In this case the EUAs are expected to trade at higher prices, “encouraging” industries and power plants to invest more in gas-based technologies, since, it pollutes far less than coal, contributing to a decrease in the amount of GHG emissions in the EU.

It is important to emphasise that, although a bigger price in the ETS market is of course important, the main driver behind power prices will always be the raw cost of commodities, therefore, if we have an expensive carbon price but a low coal price, it can still compensate to keep burning coal instead of gas.

The MSR will start operating in 2019 and is expected to see significant falls in the amount of emission permits contributing to a decrease in the current surplus.

In terms of energy price, an increase in the Emissions Trading System is not good news for citizens and companies, since that, the more expensive the emissions associated to a power plant, the higher is their bidding price, ergo pushing upwards the power prices. At current prices for coal as gas, the EUAs must be around 30 €/tone to compensate the swift from coal to gas, nevertheless the current price for the permits are already squeezing the margins of coal and coal is still fundamental in Europe’s energy mix.

Overall, we will have to pay a price to combat climate change, the question is what we are willing to abdicate more: our health or our money.

Jorge Seabra | Energy Consultant

If you found it interesting, please share it!

Recent Articles