The pathway towards Climate Neutrality by 2050 continues with coal phase-out leading the initiatives to achieve such goal across the “Old Continent”.

The official roadmap points for France to win the race of decarbonization in Europe, by phasing out of coal by 2022. In the year after is expected that Portugal, the United Kingdom, Italy and Ireland will also achieve an energy mix free from coal generation. But other candidates can dethrone these expectations and Iberian countries are in the race to beat the odds.

In 2020, Austria and Sweden started to generate their electricity completely free of energy from burning coal. The official roadmap points for a total coal phase out of France by 2022, followed by Portugal in 2023.

By 2025, the UK, Italy and Ireland will join the 13 carbon-free countries in their mix. However, the countries of the Iberian Peninsula are well positioned to anticipate the defined dates.

Spain

As planned, after June 30th, Spain should have only 5 out of 14 coal power plants online in the country (with some room for minor delays due to COVID-19). By the end of 2021, only 3 should be still connected to the grid with the decommissioning of Almeria and As Pontes, owned by Endesa.

The 3 coal plants that would remain operational are Los Barrios from Viesgo and two owned by EDP located in Asturias (Aboño and Soto de Ribera).

Figure 1 – Coal Plants in Spain. Source: LaVoz / REE

However, Viesgo surprised everyone by announcing the close of its plant Los Barrios, located in Cadiz, in June 2020 due to heavy losses of competitivity in the market. In fact, the participation of this plant has been residual during the last 12 months.

The loss of revenue lead Viesgo to revaluate the future of its coal plant and by closing it, it would be able to receive funds from the EU injected in this sector to help the phase out.

The shutdown of the 9 coal plants expected this month is related to the fact that those assets do not meet EU environmental standards and, since the owners decided not to invest to improve them, those assets are forbidden to operate after July 1st of 2020.

Endesa, despite of the investments done to meet the EU standards and keep operating on the national system beyond 2020, decided to also close the remaining two coal plants in the Peninsula (Litoral and As Pontas) by 2021 due to the losses registered in 2019 and pessimistic expectations about coal in the energy markets.

Coal has been Bearish for more than one year, falling progressively since its peak registered in October of 2018 close to 100 USD$/ton.

Despite of the downtrend of coal, the strong rise from carbon prices (EUAs) since 2018 and the consolidation in 2019 when prices reached the 30 €/ton, ( a rise of 4x in 18 months) ended up hurting coal since the over cost that coal plants had to pay due to emissions from burning coal against gas-fired plants started to be too high, giving the opportunity to gas fired plants to participate more in the energy mix.

Besides the CO2, coal demand was also damaged by the fall on the gas prices due to an oversupplied system caused by several factors such as, falls in the imports flows to Asia, milder winter, and more LNG availability.

Figure 2 – Evolution of Coal, TTF and CO2 Y+1 prices. Source: MTECH

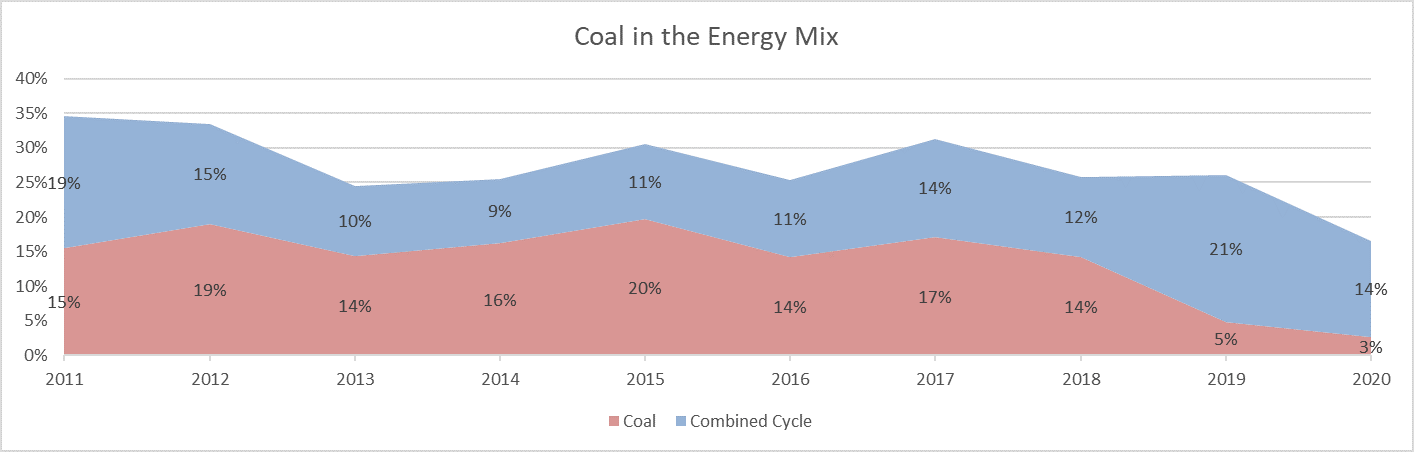

In Spain and across Europe, demand for coal fell significantly in 2019 and even more in 2020, also heavily supported by the recent COVID-19 outbreak. In the UK, data pointed for more than 90 days running without of coal generation and in Spain the participation of this fossil fuel in the mix dropped almost 10% between 2018 and 2019 and is currently contributing for just 3% of all the energy generated.

Figure 3 – Participation of Coal in the Spanish Energy Mix (%). Source: OMIE / REE

Portugal

On the other side of the boarder, the plan for the two active coal plants in Portugal is to close the Central do Pego by 2021 and Sines by 2023 but discussions about a possible anticipation of Sines deadline are growing.

According to data from REN, published in May, since March 14th that Portugal is not generating any electricity through coal and the Sines is not injecting electricity in the grid since January.

Moreover, the fall of coal in the Portuguese energy mix was 10% between 2018 and 2019 and its contribution in the 5 first months of 2020 was less than 1%, which was registered only in January.

Figure 4 – Participation of Coal in the Portuguese Energy Mix (%). Source: OMIE / REE

The government already affirmed that some evaluations about the viability to close the coal Sines before the scheduled time are being made but there some important aspects to bear in mind such as the security of supply and the future of that connection point before taking any definitive step.

Gas-fired plants have been able to compensate the absence of coal participation and the rise of renewable energy projects are helping to foresee a future without coal.

Future not so bright

With all the renewable projects expected to be online in the next months and the economic impact of the COVID-19 pandemic yet to me reflected on the energy demand, the perspectives of generating revenue from a coal plant in Iberia seem to be really low. Even more with the gas market trends that keep pointing for prices under the 15 €/MWh which, along with high costs of EUAs will keep coal out of the market against gas fired plants.

Figure 5 – TTF Future Prices. Source: MTECH

This could accelerate the decision of EDP to force the anticipated closure of its coal plants in Spain and Portugal before 2022 surpassing France in its coal phase-out plans.

Despite the obvious environmental benefits such milestone, ensuring the security of supply and price stability are key aspects that should be considered.

If you found it interesting, please share it!

Recent Articles