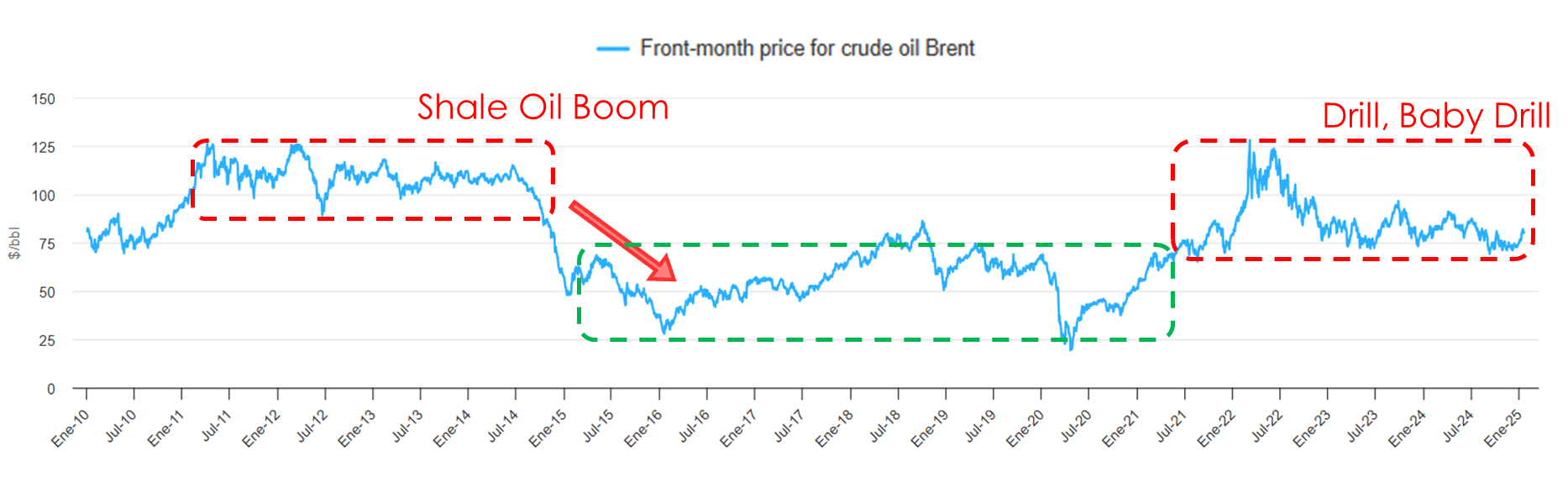

«DRILL BABY DRILL», Donald J Trump January 20, 2025

The recent inauguration of Donald Trump and his commitment to an expansive energy policy have reignited discussions about the future of oil and gas in the United States. Under the banner of “Drill, Baby, Drill”, the administration seeks to revitalise domestic hydrocarbon production, roll back regulatory restrictions, promote consumption, and withdraw from the Paris Agreement. This strategy aims to bolster America’s energy competitiveness but raises critical questions for procurement managers, financial directors, and other energy sector experts.

Could this policy spark a production boom akin to the shale oil revolution of the 2010s? Is it realistic to believe that global markets can absorb increased supply without triggering a collapse in prices? And, crucially, how does today’s context—shaped by high interest rates, the energy transition, and geopolitical uncertainty—affect the outlook? To address these questions, it is essential to reflect on past lessons, analyse current market dynamics, and evaluate the variables that could shape the market’s future.

The Shale Oil Boom and Its Lessons for the Industry

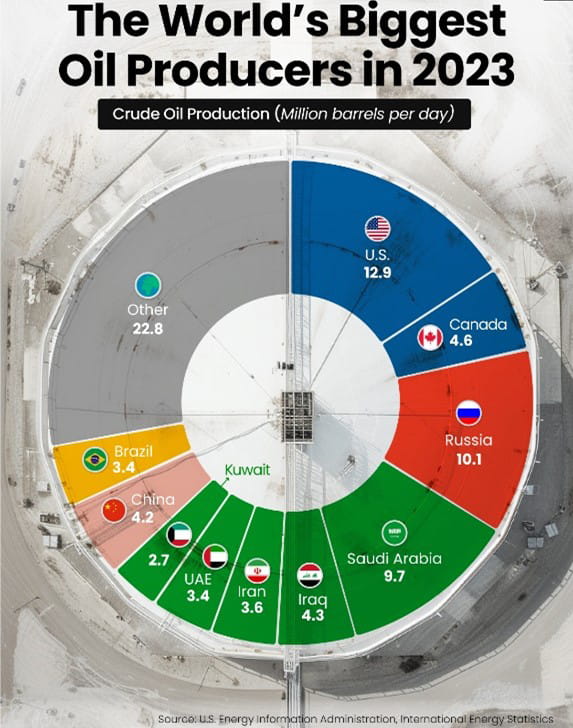

Between 2010 and 2016, the United States experienced an unprecedented energy transformation thanks to the shale oil revolution. Advanced technologies such as hydraulic fracturing and horizontal drilling unlocked vast unconventional oil reserves, solidifying the US as the world’s largest oil producer. This boom had a profound impact on global markets, flooding them with surplus supply. Combined with slowing demand, this oversupply triggered a dramatic collapse in prices beginning in 2014.

Oil prices plummeted from over $100 per barrel to lows of around $30, exposing the vulnerabilities of the sector. Many companies that had relied heavily on cheap debt to finance their expansion faced severe financial distress. While some managed to survive by improving operational efficiency and cutting costs, others succumbed to the financial pressures. This episode left an indelible lesson: unrestrained growth, particularly when financed by debt, can be disastrous in a volatile market.

Today, in 2025, the landscape is different, but the lessons of the past remain pertinent. Private companies are acutely aware of the risks associated with rapid, unchecked expansion, especially in an environment of high interest rates and significant global uncertainties.

The Current Context: A More Complex and Cautious Market

Although Trump’s policy aims to stimulate oil and gas production as a cornerstone of economic growth, today’s context differs significantly from the shale oil boom. One of the most defining factors is the historically high interest rate environment. Unlike the 2010s, when companies could access cheap credit to fuel their growth, the cost of borrowing today is substantially higher. This means investment decisions must be more judicious, with a greater emphasis on profitability and sustainability.

Globally, the market is also more intricate. The energy transition has gained considerable momentum, with electrification, renewables, and decarbonisation playing increasingly prominent roles. While the US may exit the Paris Agreement, many nations and corporations remain committed to climate goals, which could dampen long-term hydrocarbon demand. Moreover, geopolitical factors continue to shape market dynamics, from tensions in key producing regions to shifts in the strategies of major players like OPEC+ and Russia.

In this more complex environment, the “Drill, Baby, Drill” policy faces structural challenges. The global market is no longer as conducive to aggressive growth, and opportunities for expansion may be more limited than political rhetoric suggests.

Variables That Could Trigger a Price Collapse

A key concern for energy sector experts is the risk that increased US supply could lead to another price collapse. Several critical variables could contribute to such a scenario:

The role of emerging economies is pivotal. For years, countries such as India, Brazil, and those in Southeast Asia have been major drivers of global oil demand. However, in 2025, the outlook is less optimistic. Slower economic growth, exacerbated by restrictive monetary policies in advanced economies, has curbed investment and consumption in these regions. Additionally, rising food and commodity prices have constrained consumer spending power, further limiting energy demand. If emerging economies fail to regain strong growth, global oil demand may stagnate, exerting downward pressure on prices.

In China, its position as the engine of global oil demand is also under strain. The country’s transition from an investment-driven, manufacturing-based economy to one centred on domestic consumption and services has reduced its energy intensity. Meanwhile, the ongoing property market crisis has dampened infrastructure investment and broader economic activity. Furthermore, despite the US policy shift, China remains committed to its energy transition goals, which could limit its long-term reliance on hydrocarbons.

The production strategy of OPEC+ remains another crucial factor. Since the price collapse of 2020, the group has coordinated supply cuts to stabilise the market. However, internal tensions, diverging strategies between Russia and other members, and competition with the US could destabilise this balance. If OPEC+ decides to increase production to defend its market share against rising US supply, it could spark a price war reminiscent of 2014–2016, with potentially devastating effects on the market.

Business Caution: The Key to Navigating Uncertainty

In this environment, business caution is not only prudent but essential. The lessons of the shale oil boom have shown that aggressive expansion, without regard for market conditions and financial sustainability, can lead to catastrophic outcomes. For procurement managers and financial directors, this means prioritising projects with clear, sustainable returns and avoiding investments that rely solely on high oil prices to be viable.

Today’s conditions demand a disciplined approach. High interest rates, uncertainty in emerging markets, geopolitical volatility, and the global energy transition are factors that cannot be ignored. While Trump’s policy may create a more favourable short-term environment for production, the risks associated with over-expansion remain significant.

Conclusion: Striking a Delicate Balance

The energy landscape in 2025 is far from straightforward. While the rhetoric of “Drill, Baby, Drill” may sound appealing politically, the global market is more volatile and complex than ever. Private companies, having learned from past experiences, are wise to adopt a cautious stance and focus on financial and operational sustainability. If the shale oil boom taught us anything, it is that balancing growth with discipline can make the difference between success and failure in an ever-changing energy sector.

If you found it interesting, please share it!

Recent Articles