The need to reduce greenhouse gas emissions, while supporting the development of low-carbon technologies, has led to the creation of a global carbon market, with its related carbon credit trading systems, and with its related greenhouse gas emission rights buying and selling activities. This market has developed since the signing of the 1997 Kyoto Agreement (and then the 2016 Paris Agreement), which set greenhouse gas emission reduction obligations for industrialized countries. The key concept is the idea of creating an economic incentive to reduce emissions and promote sustainable practices by placing an economic value on GHG emissions.

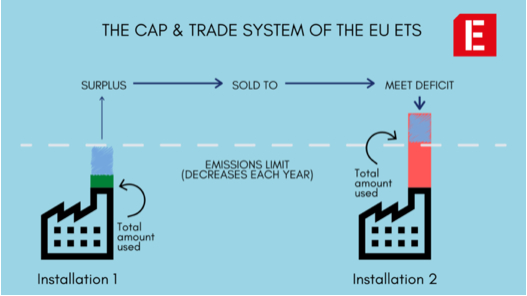

At the Global level, the most developed and well-established trading system is the EU ETS (European Union Emission Trading System), introduced since 2005. It covers various sectors, including manufacturing, electricity, and aviation within the EU. The system allocates a limited number of emission credits to each installation covered by the system (a credit represents the right to emit a certain amount of greenhouse gases). A portion of the emission credits is allocated free of charge to companies, while the remainder is auctioned. Companies can participate in auctions to purchase additional credits if necessary. At the end of each compliance period, companies must surrender at least the number of credits equivalent to their actual emissions; penalties may be applied for violating the rules. Over the years, the number of credits allocated for free has decreased. The EU ETS also includes the possibility for companies to use emission reduction credits from projects outside the EU ETS or to purchase additional allowances outside the system.

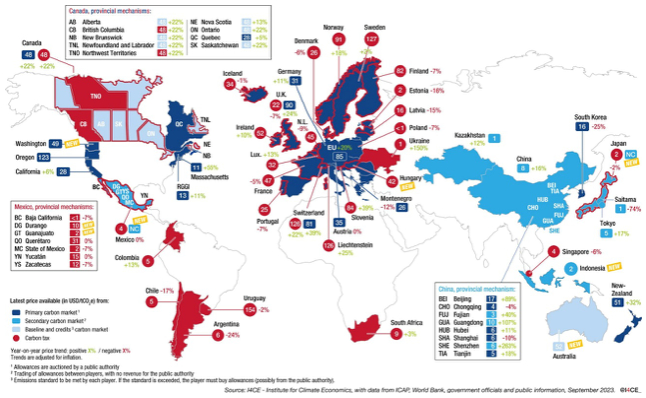

In addition to the EU ETS there are several carbon market schemes around the world. Their complexity and diversity reflect the global and interconnected nature of the climate change challenge. We see some examples in the image below.

These schemes are subject to periodic revisions. Regular updates are introduced to improve the effectiveness of the system and adapt it to changes, in needs and priorities in the fight against climate change.

And here, the question arises: what changes are planned to start this year?

At the European level, a series of reforms to the European Union’s carbon market are planned as part of the strategy to strengthen the ETS (Emission Trading System) and achieve more ambitious climate goals. Here are the main reforms:

- Reducing the Supply of Permits: The EU will reduce the amount of CO2 permits added to the carbon market by decreasing the cap on permits each year. The fastest reduction in permit supply in the program, includes two extraordinary cuts, the first of which will occur in 2024. The rate of decrease in the carbon permit cap will fall by 4.3 percent from 2024 to 2027 and 4.4 percent from 2028 to 2030.

- Inclusion of the Maritime Sector: For the first time, the EU will force ships to buy CO2 permits.

- Inclusion of the Transport and Buildings Sector: It has been determined that starting in 2027, new CO2 costs will be imposed on fuels used in road transport and buildings.

- Gradual Elimination of Free Permits: Between 2026 and 2034, the EU will phase out free CO2 permits given to industries to protect them from foreign competition.

- New Carbon Market for Fuel Suppliers: From 2027, a new carbon market will be launched to cover suppliers of CO2-emitting fuels used in cars and buildings.

- Emission Reduction Goal: The overall goal is to reduce emissions by 62 percent below 2005 levels by 2030, in line with the EU target to reduce net emissions by 55 percent by 2030 compared to 1990 levels (fit for 55 program).

Progress is also expected in standardizing carbon offsets, with the involvement of both government institutions and private market organizations.

These reforms are part of a broader EU effort to lead a transition to a low-carbon economy and to respond effectively to the climate crisis. EU carbon market reforms for 2024 will lead to the introduction of several market mechanisms and policies. Let’s look at some of them:

- Emission Reduction Incentives: Reducing the supply of permits increases the cost of emissions, incentivizing companies to invest in clean technologies and improve energy efficiency, especially for those sectors entering the market for the first time.

- Rising Carbon Prices: As available credits decrease, prices for them could rise, further pushing companies to explore new markets and projects to offset or reduce their emissions.

- More Stringent Regulatory Policies: The EU could introduce additional regulations to ensure compliance with new restrictions and encourage a faster transition to renewable energy and low carbon solutions.

- More Aggressive Strategies and Investments in Renewables and Clean Technologies: Companies could seek to reduce their dependence on fossil fuels by shifting investments to renewable energy sources and low carbon technologies.

- Development of National or Regional Carbon Markets: Some countries or regions could develop their own emissions trading systems or adopt similar policies to align with EU standards.

- Increased International Collaboration: There could be increased international cooperation in terms of climate policies, with non-EU countries adopting similar measures or collaborating with the EU on emission reduction projects. Indeed, investors are looking to other carbon markets to diversify and find new opportunities for decarbonization.

Globally, there are also plans to extend carbon tariffs to countries such as the United Kingdom, Canada, and Australia (which will develop their own carbon tariffs), and the creation of genuine New Carbon Markets, such as like the cap-and-invest scheme in Washington state, U.S., and Mexico’s transition to a fully operational emissions trading system. The whole world is mobilizing to reform existing markets, such as in California, where they are finalizing reforms to stabilize prices and increase ambition in climate policy.

These trends indicate a changing landscape in the global carbon market, with new policies, market mechanisms, and sectors coming into play, as well as a growing recognition of the role of carbon pricing in achieving decarbonization goals.

Guenda Hehmann | Energy Expert

If you found it interesting, please share it!

Recent Articles