It’s fascinating how a single event can turn the entire board upside down. Before 2022, the idea of a one-to-one correlation between gas prices in Texas and Amsterdam sounded like science fiction. They were worlds apart. The American Henry Hub—always cheap, always predictable—and the European TTF… well, the TTF was a different story, tied to its own regional dramas.

But all of that changed.

The invasion of Ukraine was not only a humanitarian catastrophe; it was the hammer that shattered the old energy order. What we have seen since then—especially in 2024 and 2025—is not mere fluctuation. It is a total reconfiguration. The gas market has been forcibly globalized, and now everyone is watching the same thing: LNG cargoes crossing the Atlantic.

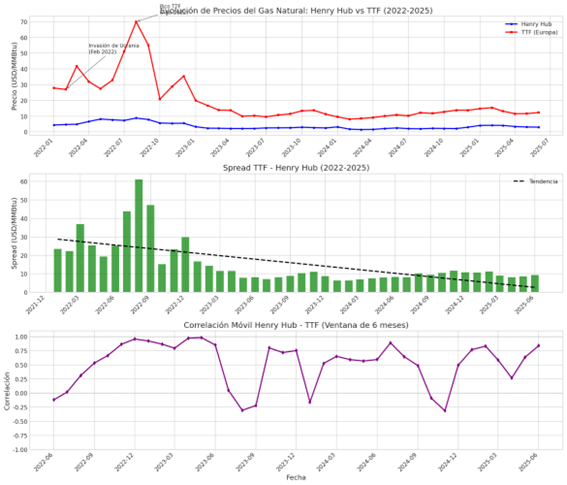

Chart: The story of the past few years in three curves. Top: price madness. Middle: the shrinking spread. Bottom: the correction showing that everything is now connected. (Data: FRED, EIA, World Bank)

On one side, there is Henry Hub. The cornerstone. For years, it reflected the abundance of American shale gas. Prices were low. Volatility was contained. But something has changed. Suddenly, Henry Hub started looking outward. LNG export terminals, once an afterthought, are now the main driver of demand. We got a warning at the end of 2025, when a cold snap and international market hunger pushed prices above $5/MMBtu—a level not seen since the 2022 frenzy. It is no longer just a local market. Not at all.

Then there is the TTF. The epicenter of chaos. It is hard to exaggerate what happened in Europe. Seeing the TTF approach $70/MMBtu in August 2022 was… surreal. Total panic fueled by the Russian gas cut. But Europe responded. Boy, did it respond. Storage facilities were filled to the brim, households turned down thermostats, and, above all, LNG imports were opened wide. The result was a price collapse nearly as dramatic as the spike. By the end of 2025, the TTF was already below $10—a new normal.

LNG to the rescue (and the deal of the century)

Europe’s strategy was simple: buy all gas that was not Russian. That’s where the United States raised its hand. In 2025, 77.53% of Europe’s LNG imports came from American cargoes. A staggering figure. This was not a temporary fix; it is the new status quo. The European Parliament made it clear in December 2025: by 2027, not a single molecule of Russian gas. End of story. LNG—and particularly U.S. LNG—is now central to European energy security.

The arbitrage that changed everything

Here is where it gets interesting. Previously, HH and TTF prices lived separate lives. Now, they are intimately linked. Why? Because the U.S. has become the supplier that sets Europe’s final price. TTF prices are essentially Henry Hub prices plus the cost of liquefaction, shipping across the ocean, and regasification. It’s an arbitrage—a physical and economic bridge that didn’t exist on this scale before. The moving correlation chart says it all. From nearly zero, correlation has exploded, peaking above 0.8 in 2025. They are dancing to the same rhythm.

And now, what?

Geopolitics comes into play. Here we are, early 2026. The logical consequence is clear. The spread—the price difference between TTF and Henry Hub—has shrunk to its minimum. In December 2025, it was just $4/MMBtu. So low that, for the first time since 2021, European prices fell below the long-term cost of producing and shipping LNG from the U.S.

But this new reality raises uncomfortable questions. Has Europe simply swapped one dependency for another? The short answer: yes. From relying on Gazprom pipelines to relying on LNG tankers from the Gulf of Mexico.

Sure, the U.S. is an ally. Not Russia. But politics is politics. And the Trump administration has not hesitated to use LNG as a geopolitical tool. We have seen its “energy dominance” strategy in action: pressuring allies to sign long-term contracts, threatening trade tariffs if they do not comply, and even attempting to weaken European climate legislation—such as methane emission rules—to ease the entry of its gas. LNG has ceased to be just a commodity and has become an instrument of coercive diplomacy.

So, is there codependency?

Absolutely. Europe desperately needs U.S. gas to keep its economy running. But make no mistake—America also needs Europe. With the massive new wave of liquefaction capacity about to flood the market, Washington needs a large, reliable, and well-financed buyer. Europe is that buyer. Without the European market, the U.S. LNG industry would face a very serious problem.

However, this codependency is not symmetrical. It is an asymmetric power relationship. The U.S. has more options; it can always divert shipments to Asia if prices are higher. Europe, in contrast, has burned its bridges with Russia. Its options are limited. This gives Washington considerable leverage—a leverage it, as we have seen, does not hesitate to use.

The market has found a new equilibrium, yes—but it is a far more politicized one. Prices no longer depend solely on supply and demand. They now also hinge on trade agreements, political pressures, and who occupies the White House. The Atlantic has never seemed narrower, yet more complex.

If you found it interesting, please share it!

Recent Articles