In recent years, the European electricity market has shown some shortcomings in energy crisis situations. This has led to the need for short- and long-term measures.

In March 2023, the European Commission presented the first draft of the proposed reform of the electricity market. This draft does not vary significantly from the final document approved by the Council on 17 October. The Council’s approval opens the door for negotiations to begin with the European Parliament, so that it can finally become European law.

The reform addresses five key levers: the intraday market, Power Purchase Agreements (PPAs), Contracts for Difference (CFDs) and consumer protection.

Firstly, the reform maintains the marginal electricity market without any modification. This mechanism establishes that the bid that closes the market will set the price for all bids that have offered a price equal to or lower than the market price.

In the area of the intraday markets, the reform proposes a reduction and definition of the closure of intraday markets closer to the time of supply. Intraday markets are used by market participants to adjust their positions in the day-ahead market. In the case of renewable technologies, this modification is essential as they can only estimate their production accurately when the time of supply is approaching. It also emphasises the need for intraday markets to adapt and include renewable production, demand response and energy storage.

In addition, the reform also proposes that short-term electricity markets should reduce the minimum offer size to ensure the participation of small-scale providers of flexibility services.

With regard to virtual hubs, the reform advocates the improvement of futures markets through the establishment of regional virtual hubs. The aim is to reduce market fragmentation and liquidity in some parts of Europe. On the other hand, they are called “virtual” because they would not be a new entity per se, but a price aggregator. In other words, these hubs should cover several supply areas and reflect the aggregate price of these areas. This price will serve as a reference for market operators to offer their futures hedges in these areas with low liquidity.

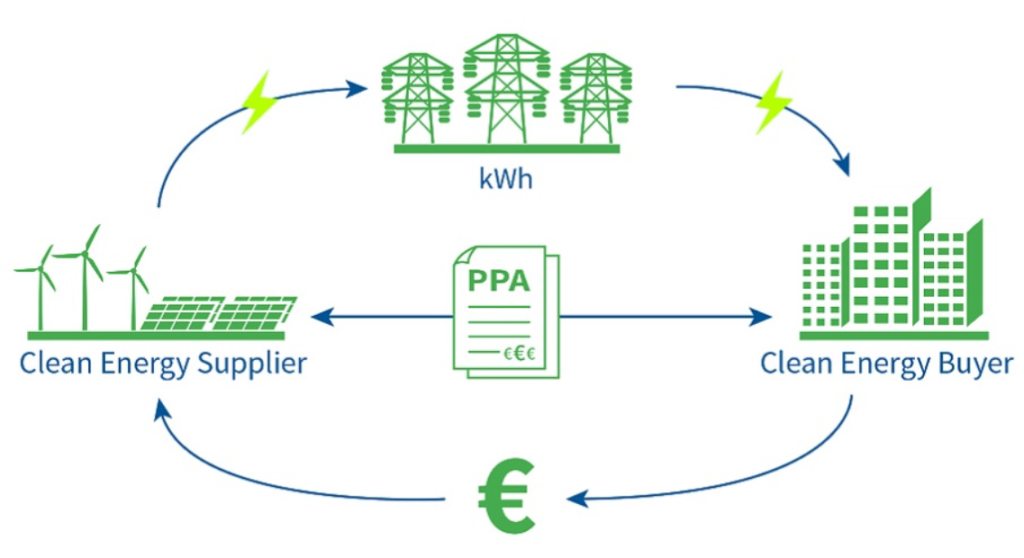

The reform also addresses Power Purchase Agreements (PPAs), long-term power purchase and sale agreements between a generator and a consumer. The agreement establishes the predetermined price that the consumer will pay and the characteristics of the energy supply. In this way, investors make investments in renewable energy with a guaranteed sale price.

How PPAs work. Source: Consilium Europa EU

The reform proposes that Member States should provide a system of market-based guarantees when private guarantees to access a PPA are not available are not accessible or sufficient. Furthermore, Member States are given the option to facilitate the aggregation of consumption of different consumers, which could result in a more attractive volume for accessing PPAs. Furthermore, it underlines the importance of removing all unjustified barriers and facilitating cross-border PPPs, as these elements are crucial for the proper functioning of the market.

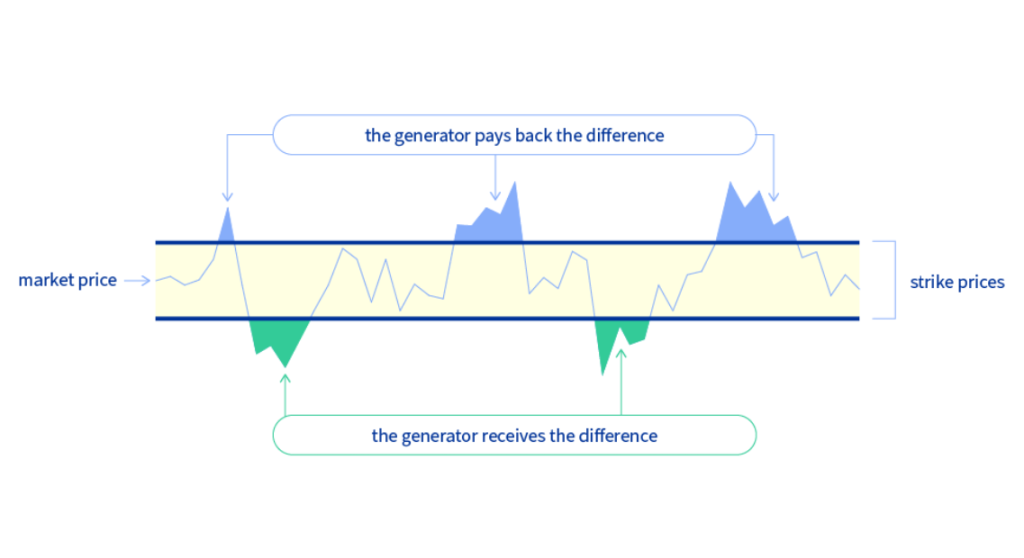

Regarding Contracts for Difference (CFDs), it is established that, in case member states decide to support low-carbon projects with public financing, these must be structured as two-way contracts for difference. This may also apply to new investments aimed at repowering existing power generation facilities or substantially increasing their capacity or extending their lifetime. Technologies that are at an early stage of deployment are excluded from this type of contract.

The way two-way contracts for difference work is that the generator and the counterparty set a maximum price range, within which the contract for difference (CFD) will not be triggered, and the generator will receive the full amount. In the event that the market price falls below the minimum limit set by the spread, the generator will receive the difference between the spread price and the market price. In the opposite situation, if the market price exceeds the ceiling of the range, the generator shall pay the difference between the market price and the ceiling of the range.

How CFDs work. Source: Consilium Europa EU

How CFDs work. Source: Consilium Europa EU

The reform encourages Member States to pass on the benefits of CFDs to final consumers, especially those in vulnerable situations. Optionally, it also proposes to use them to finance investments that reduce electricity costs for final consumers or to finance the costs of a direct price support scheme.

In relation to excess production, it is proposed that consumers with storage or generation facilities have the right to share excess production, either at a given price or free of charge. These payments can be made directly between consumers or automatically via peer-to-peer trading platforms.

Finally, in order to protect consumers, the reform proposes greater transparency in energy contracts, the right to access fixed price contracts and the implementation of a marketer of last resort in the event of supplier failure, ensuring continuity of supply.

Conclusions:

The reform of the electricity market was expected to bring significant changes, particularly in the area of the marginal system, a system that has proved effective over the years but may not be appropriate in situations of energy crisis.

On one hand, the marginalist approach ensures fair remuneration for generators, but in times of crisis it can be detrimental to consumers and very beneficial for generators with lower operating costs. On the other hand, high prices may motivate member states to accelerate the implementation of renewable energies in their territories and, in some cases, to prolong or maintain nuclear parks in operation in the coming years.

In the Spanish context, the Iberian adjustment mechanism was designed to counteract these excessive benefits by capping the price of gas used in energy production.

In addition, an extra difficulty is added to the modification of the marginalist market: Europe is on the way to achieving an energy market. This single energy market must cover the needs of its member states, which are very different in terms of generation capacity and technical and geographical characteristics. Therefore, any changes must be made with great care.

As far as PPAs are concerned, they have historically been limited to large consumers with specific requirements, which has resulted in this being a high-end product difficult to reach for most consumers. This is sometimes due to volume restrictions or the need for guarantees that are inaccessible. The proposal seeks solutions to both of these problems by offering a warranty scheme and facilitating the aggregation of consumption.

The implementation of two-way contracts for difference in publicly funded projects offers stability to producers and, at the same time, avoids excessive profits. In addition, it is very positive that final consumers can benefit from these gains, either by reducing their energy costs or through projects. In my view, each member state should develop a framework for distributing these benefits, prioritising the most vulnerable consumers.

In short, the reform has established the basis for each Member State to propose the specific measures to be applied in its country, according to its specific characteristics. This is why we have the feeling that we know the basis of each measure but are unable to analyse its real viability. This leaves us with many questions that we will not be able to resolve until each Member State’s application becomes European law.

In conclusion, initial expectations were high for a reform that has finally introduced cautious measures. This has led to general dissatisfaction given that in many cases the changes introduced are considered insufficient to mitigate the real impact of a possible energy crisis.

For now, we must wait for the European Parliament to approve the reform and see how each Member State implements its measures at national level. The agreement is expected to be fully closed before the end of 2023.

If you found it interesting, please share it!

Recent Articles