It was in 1997 when the process of liberalization of the electricity market in Spain began. This process, which was gradually established until its culmination in 2009, brought an important novelty to consumers: for the first time they had the option to choose which electric supplier they wanted, and with this, doubts arose: will it be reliable to leave my traditional supplier? Will I run the risk of having my electricity supply cut off? Will I really pay less as advertising ensures?

Throughout this article, I will try to summarize how the path has been in these 20 years, through which we have gone from a 100% regulated market, to having hundreds of free suppliers, and I will try to answer some of the questions raised above.

From 5 to hundreds

On July 1, 2009, the “Ley 27/2007” law came into force, by which the electricity market was liberalized, as happened before with telephony and Internet. The electric suppliers that came into play at that time were those created by the 5 major electricity companies at the time (Endesa, Iberdrola, Unión Fenosa, E.ON and HC Energía), but soon competitors emerged.

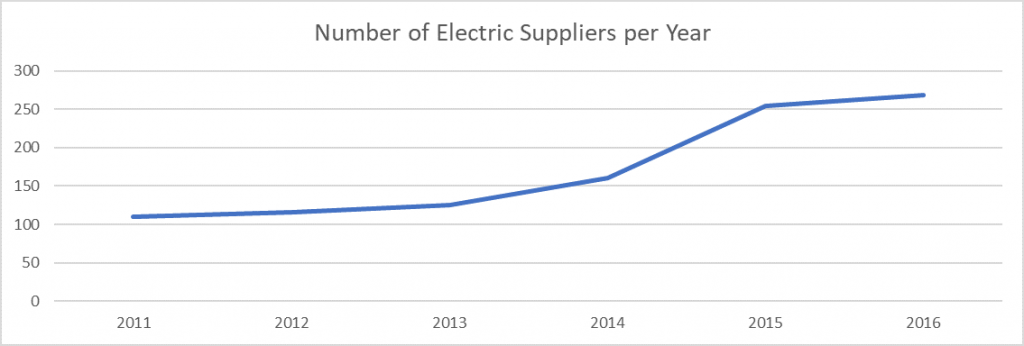

Below, we can see a graph that shows the evolution in the number of active electric suppliers according to CNMC reports from 2011 to 2016 (year in which, by the way, the number of consumers in the free market was higher than those with regulated price):

The promise of the reduction in the invoice price was one of the main weapons of the new suppliers when it came to attract new customers, and as we see in the following chart, in general, the promise was fulfilled (especially in the domestic and SME sector):

Evolution of the supply price (€/MWh) in free market according to the type of supplier:

In addition to the price, there were other claims: transparency, commercialization of renewable energy, personalized treatment that could translate into savings (such as capacity adjustments or supervision of reactive energy penalties), among others. Some suppliers would fulfill their promises more than others, but with these arguments, dozens of them made their small space in the world of energy sales.

In addition to the attractive claims offered to customers to differentiate themselves from the traditional energetic companies, another factor influenced the boom of suppliers: low entry barriers.

The fact that profit margins are becoming more and more adjusted, coupled with increasingly demanding entry conditions, have caused the increase in new suppliers to be reduced in recent years.

Large in number, but not in volume

Considering the above, we could think that the big energy companies are in a serious problem, that they have to share their slice of the cake with too many competitors and that the energy oligopoly is a thing of the past. But, nothing is further from the truth, the following graphics show us that, despite the high number of competitors, the 5 big companies continue to dominate the market in a forceful way:

Evolution of the energy shares supplied in the free market by group of suppliers and by consumer segment:

If we consider the share of energy supplied in the entire market for the domestic sector (not only that of the free market, but also that of customers in the regulated market), the percentage is even smaller for the small suppliers:

Evolution of the energy shares supplied throughout all the market (free + regulated) per group of suppliers for the domestic sector:

The latest information we have available tells us that the new electric suppliers increased their market share to 6.7% in 2017, an increase of 1.9% compared to the previous year.

And the shadows arrive…

The cases of fraud related to the energy commercialization have been happening since almost the beginning of the market liberalization, being in 2012, when for the first time a supplier was disabled, “AE3000”, setting an important precedent.

To date, CNMC has processed thirty disqualification procedures, of which 21 have ended with the disabling of the supplier.

The hole generated by these electricity companies is estimated at around 100 million euros, of which some 72 have been paid by Unesa’s five large electricity companies (Endesa, Iberdrola, Gas Natural Fenosa, EDP and Viesgo).

This type of fraud, far from entailing a high complexity or consist in scams of different kinds, have been carried out almost always in a very similar way. To try to understand what the fraud consists of, we will make a summary of what has been the biggest case of fraud in our country:

“Ámbar” Operation

On November 30, 2017, CNMC informs on its official website that the criminal organization that carried out what has been the biggest scam in the field of electric power commercialization to date has been dismantled. On that day, it is reported the detention of 14 people in 5 provinces in the one named “Ámbar” operation.

The organization managed to defraud 60 million euros between the years 2012 and 2017.

The way of operating was relatively simple. In 2012, a network began to operate that created several instrumental companies to commercialize electric power. These companies (which were in the name of front men), got customers (generally SMEs), offering energy at a cost between 20% and 30% lower than the market. This suppliers network, at first bought energy from the generators and paid the distributors for the transportation of electricity of the supply points of their customers; up to here everything normal. After a while, these suppliers reduced

the amount of energy they bought from the generators and began to stop paying the bills to the distributors, but they still offered the service normally to their customers.

The most important part of the fraud (60 million euros) is generated by the fact that afterwards they did not liquidate the differences between the energy sold to customers and the invoices owed to their distributors. After a few months, when the distributor demanded payment, the company disappeared, and the entrepreneurs re-created new companies with front men to continue the fraud. Thus, 13 suppliers with fraudulent activities uncovered, all directed by the same businessman and with a portfolio of about 4,000 supplies. Due to this scam, the country has not billed 14 million euros in taxes.

On December 1, 2017, we knew that the head of the plot, “Esteban Roig Padrosa,” was entering prison, and the rest of the investigators were released.

What measures should we apply

It seems quite clear that measures must be taken to prevent past abuses from happening again, but it is not an easy task. Some of the main problems that existed until 2016 (when the law was modified) were the action periods. When a supplier did not buy the electricity in the market and went to the adjustment market to acquire it without money, the first notice was notified to the seventh month.

It was in the eleventh month, when the decision of submit a complaint was made, which reached the National Commission of Markets and Competition (CNMC), and an investigation was opened. Several months or a year went by again until it was decided to sanction the company, with a very small fine in comparison to the swindled, and that was when the Ministry of Industry acted on the matter.

It had been two years and the company continued to cheat. It was not until after a few more months, when the Ministry issued a resolution disabling the supplier.

When the appropriate body had imposed the sanctions, the companies no longer existed, and they had no customers. In some cases, even, the suppliers had passed their customers to a new company to start again with the same scam.

The term of the investigation procedure has already been reduced to six months, but the big electricity companies still consider it excessive, since it allows the accumulation of economic damages. In this regard, they have asked the Ministry of Energy to expedite the process and the precautionary suspension of the marketers since the first breaches are detected. Likewise, they request that the required guarantees be sufficiently high to cover the amounts until the final disqualification, as well as a solution to the financing that the rest of the agents of the system have to assume, arrives.

On the other side of the coin, we have the fact that putting too many requirements, could jeopardize the free market competition.

What can we expect in the coming years

In the future, to the suppliers who try to make their way in the energy market, it does not seem to wait them a bed of roses. The big energy companies do not seem willing to let their market share be removed, and they will fight for regulation to favor them.

As an example, in July 2017, the Supreme Court gave free rein to the fact that the big electric companies could access the client portfolio of the independent suppliers in the joint database known as SIPS (information system for supply points of natural gas and electricity). This fact was taken to the CNMC as a consultation by the Association of Independent Suppliers (ACIE), requesting changes in the information on the user’s supplier so that its competitive position would not be put at risk. At the beginning of the year, the CNMC positioned itself in favor of small electricity companies and the characteristics of this database (SIPS) were established through “Real Decreto 1074/2015” law, in which certain orders in the electricity sector have already been modified by the Ministry of Energy. In the final drafting of this standard and after the report of the CNMC, it was decided not to include in the database the information that directly identifies the consumer (name and address of the owner of the supply point and location of said point).

Possibly in the next few years we will witness more disputes of this kind. In this regard, in February of this year the European Association of Independent Energy Suppliers was born in Madrid. This is the first European network of national associations of independent suppliers, whose objective explains Michele Governatori (designated president of EER for 2018 and 2019): “Our target is to represent with a single voice the independent energy companies that operate in our countries. We decided to join experiences in different countries of the EU to provide more information and suggestions to the EU and the institutions of the member states on how to promote competitiveness in markets and technological development in our industry”.

Competitiveness yes, but with guarantees

Personally, I think that competitiveness is always a good thing for consumers and the market in general. I hope to see for the coming years a fair game board for the different participants in our energy market, with rules, in addition, that guarantee security for all (including consumers) and that prevent opportunists from breaking the rules, damaging the whole system.

For this, we will need that those who make the laws, do so with firmness, justice and courage, making legislative changes that do not lead us to more legal uncertainty, but quite the opposite.

In their hands is the responsibility to work for that energy market with more lights, and less shadows, that we desire so much.

Ismael Abordan| Energy Consultant

If you found it interesting, please share it!

Recent Articles