The Spanish electricity market has evolved significantly over the past decades, driven by the energy transition and European commitments to decarbonization. The country has opted for an energy mix based on renewables, with a strong presence of wind and photovoltaic solar power, which has reduced dependence on fossil fuels and improved the sustainability of the system.

New energy model challenges

However, this new energy model also presents major challenges. The intermittency of renewables introduces greater volatility in electricity generation, making supply security increasingly dependent on flexible technologies and backup systems. Additionally, the gradual shutdown of coal-fired power plants and the planned nuclear phase-out over the coming years could reduce the available firm generation capacity. This lower backup capacity, combined with rising electricity demand driven by the electrification of transport and industry, increases the risk of high prices during periods of scarcity.

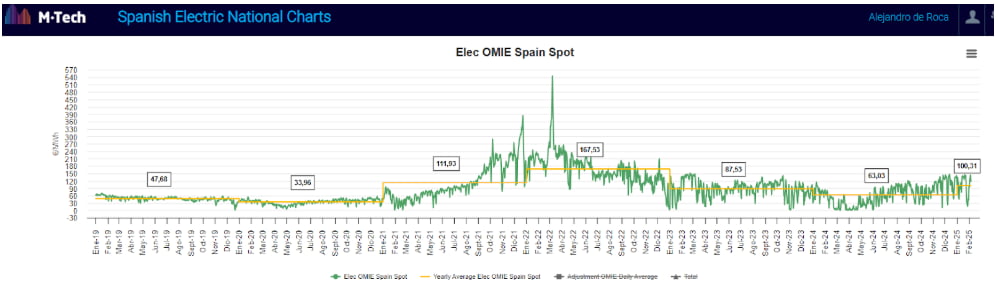

Elec OMIE Spain Spot

Furthermore, the market continues to experience low interconnection with the rest of Europe, standing at only 4.7% in 2023, far from the 15% target for 2030, limiting integration with European electricity markets and increasing reliance on domestic resources.

In this context, mechanisms are needed to ensure both long-term availability of firm generation and the system’s ability to adjust to fluctuations in supply and demand in real time. This is where capacity and balancing markets come into play, serving as essential tools to maintain the stability and efficiency of the Spanish electricity market.

Capacity Markets

Capacity markets aim to ensure that the electricity system always has enough firm and flexible generation available, even during periods of high demand or low renewable production. In a marginal pricing market like Spain’s, short-term price signals are not always enough to incentivize investment in new infrastructure, making complementary mechanisms necessary.

Operation and Compensation: Spain has implemented several capacity schemes to ensure the viability of firm generation assets and promote new investments:

- Availability payments, which compensate certain facilities for committing to be operational when needed.

- New capacity mechanisms, based on competitive auctions to encourage investment in strategic technologies such as storage and demand response.

- Market-based capacity mechanisms, where generators compete in auctions to guarantee long-term supply at the lowest possible cost.

Compensation in these mechanisms is granted based on the availability and response capability of each facility, aiming to optimize costs for consumers while ensuring a reliable electricity supply.

Participants and Platforms: Capacity markets are open to conventional generators (combined cycle, nuclear, hydro), storage systems (batteries, pumped hydro), and large industrial consumers that can reduce their demand during critical periods.

These mechanisms play a crucial role in a high-renewable penetration market, ensuring supply security without resorting to exceptional measures like the Iberian mechanism, which expired in December 2023 and was originally designed to temporarily lower electricity prices.

Balancing Markets

Balancing markets are designed to correct deviations between electricity generation and consumption in real time, ensuring system stability. Since electricity cannot be economically stored at large scales, any imbalance must be addressed immediately to prevent blackouts or quality issues in supply.

Spain has developed a balancing market framework aligned with European regulations, consisting of different response levels:

- Primary reserve (FCR – Frequency Containment Reserve): Immediate response to frequency deviations. In Spain, it is mandatory for certain generators but is not remunerated.

- Secondary reserve (aFRR – automatic Frequency Restoration Reserve): Automatic adjustments within seconds by activating generation or demand reserves.

- Tertiary reserve (mFRR – manual Frequency Restoration Reserve): Manual adjustments that are activated within minutes to correct grid imbalances.

- Replacement reserve (TERRE – Trans European Replacement Reserve Exchange): A European balancing mechanism coordinating transnational replacement reserves.

Each of these markets has increasingly stringent requirements. For example, a generator participating in the secondary reserve must be able to modify its output in less than 30 seconds, while in the tertiary reserve, adjustments can take several minutes. Due to the high level of requirements, remuneration in these markets is significant and varies depending on supply and demand at any given time. Balancing markets are open to conventional generators, renewable producers with fast-response capability, large industrial consumers, and storage systems, such as batteries.

Spain participates in several European balancing platforms, including TERRE (replacement reserve) and IGCC (imbalance compensation), and has worked towards integration into MARI (manual tertiary reserve) and PICASSO (automatic secondary reserve).

We would like to highlight the Active Demand Response Mechanism, in which MAGNUS Commodities has supported its clients. This mechanism is primarily integrated into balancing markets, allowing industrial, commercial consumers, and aggregators to adjust their electricity consumption in real time to stabilize the power system. Its participation is crucial in secondary reserve (aFRR), with automatic adjustments within seconds; tertiary reserve (mFRR), with manual activations within minutes; and replacement reserve (TERRE), which operates at the European level. Although its primary role is in balancing markets, demand response can also participate in capacity mechanisms, committing to reducing consumption in critical moments to ensure sufficient firm capacity. However, in Spain, its presence in capacity markets remains limited due to regulatory barriers favouring traditional generators. The European Commission has urged Spain to facilitate demand response access by eliminating technical restrictions and simplifying prequalification procedures.

On the other hand, the 2022 energy crisis exposed Europe’s vulnerability due to its high dependence on Russian gas, whose supply was drastically reduced following the invasion of Ukraine. This led to a sharp increase in gas and electricity prices, forcing the EU to diversify suppliers, promote LNG, and accelerate the renewable transition. However, the lack of interconnections and storage remains a challenge in reducing long-term dependency.

How Can Capacity and Balancing Markets Reduce Gas Dependency?

The development and European integration of these mechanisms will allow us to:

- Energy Storage Development: One of the key mechanisms to reduce gas dependency is enabling the use of renewable energy surpluses during low-demand periods and storing them for use when weather conditions do not favour generation. Spain has already set ambitious targets in this area, with plans to reach 20 GW of storage capacity by 2030 and 30 GW by 2050. Capacity markets can accelerate this transition by incentivizing investment in batteries and pumped hydro storage, ensuring a reliable alternative to combined cycle gas plants in the future. Additionally, the recent reform of balancing markets has opened the door for storage to participate on equal terms with conventional technologies, improving its profitability and viability.

- Increased Demand Response Participation: Demand response enables electricity consumption to adjust based on the availability of renewable generation. Through balancing markets, industries and large consumers can reduce their electricity usage during grid stress in exchange for financial incentives, thus decreasing reliance on combined cycle gas plants. Spain has made progress in regulating demand aggregators, which allow multiple small consumers to coordinate and participate in these markets. However, the European Commission has pointed out that regulatory barriers still hinder the entry of these actors, limiting the full potential of this solution.

- Interconnections and Diversification of Backup Energy Sources: Increasing interconnection capacity with the rest of Europe is another key strategy to reduce gas dependency. Currently, Spain has a low interconnection level (4.7% in 2023), far from the 15% target for 2030. This means that during periods of low renewable generation, the country has few alternatives beyond gas to ensure supply. Capacity and balancing markets can be integrated with European energy exchange mechanisms, enabling greater electricity imports from France, Portugal, and other countries when renewable production is insufficient. Additionally, new interconnections with Portugal, France, Morocco, and Andorra are being developed, which in the future could help diversify Spain’s backup energy sources.

Conclusion

While capacity and balancing markets can reduce the need for gas-fired generation, there are still structural challenges that must be addressed. The limited maturity of storage technologies and the lack of efficient demand management continue to restrict the system’s ability to operate without relying on combined cycle plants.

One of the positive aspects of Spain’s regulatory framework is its alignment with European guidelines, enabling integration into cross-border balancing platforms and fostering competition in capacity markets.

However, there are areas for improvement. The low level of interconnection with the rest of Europe remains a structural problem, limiting market efficiency. Additionally, the European Commission has highlighted that Spain’s forward markets lack liquidity, making risk hedging more difficult for market participants and increasing price volatility.

Another area requiring improvement is removing regulatory barriers that limit the participation of independent aggregators and storage in balancing markets, which remains an unresolved challenge. It is also recommended to define a clear roadmap for the gradual phase-out of PVPC (Voluntary Price for Small Consumers), which, while protecting vulnerable consumers, can distort competition in the retail market.

In short, Spain has built a solid framework to ensure electricity system stability during the energy transition, but it must continue advancing in market integration with Europe, improving forward market liquidity, and removing barriers that hinder greater flexibility and participation of new players in capacity and balancing mechanisms.

If you found it interesting, please share it!

Recent Articles