For decades, European energy security rested on long-term natural gas supply contracts, known as LTCs, which traditionally covered more than 80% of demand. These contracts provided stability and predictability for both producers and consumers. They allowed for robust investments in key infrastructure.

But things have changed. Today, Europe is much more exposed to the spot market and flexible liquefied natural gas (LNG). This transformation has radically changed how gas is secured on the continent.

This shift was not accidental. Russia’s invasion of Ukraine in 2022 accelerated high-impact policy decisions. The REPowerEU plan marked a turning point: to phase out energy dependence on Russia.

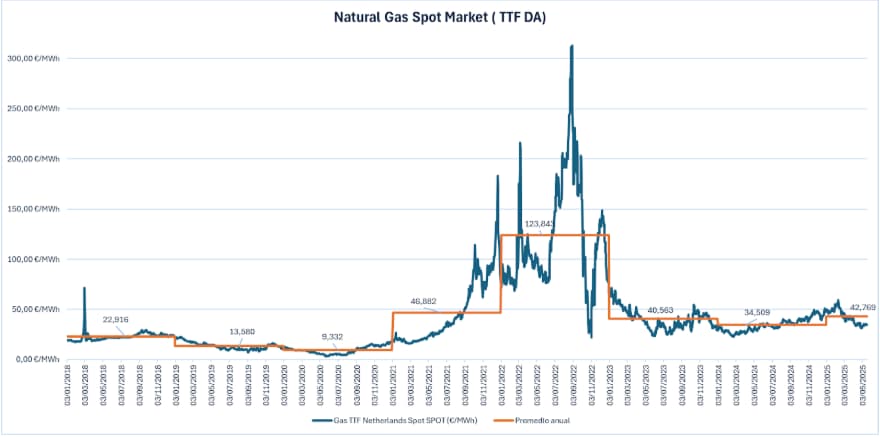

The consequences have been extensively commented on, but what remains highlighted is the fact that the average price of Natural Gas on which the European economy has developed (prior to COVID and the war in Ukraine) in the last 20 years is a distant memory and right now, Europe has started to pay average prices 2 or 3 times higher. All this conditioning the competitiveness of the energy markets of the old continent. One of the pillars of energy policies along with security of supply and sustainability.

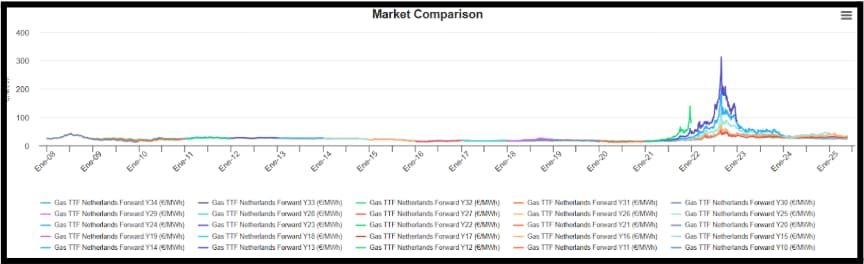

Historical chart of market futures prices from Cal10 to Cal33

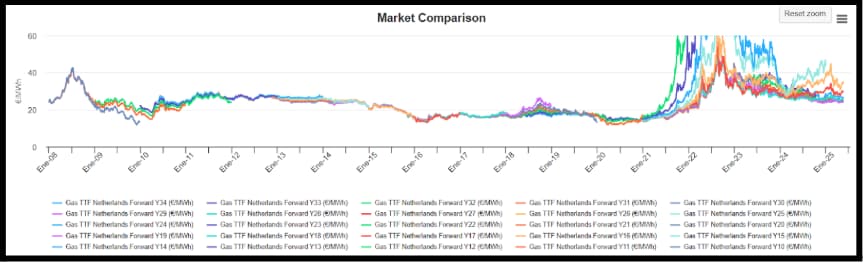

Zoom-in the front chart.

In this article, we analyse why Europe has left behind its traditional commitment to long-term contracts (which provided security and greater competitiveness), the risks that this entails, and the challenges involved in building a solid, flexible and sustainable energy model in such a volatile and geopolitically complex environment.

The REPowerEU plan and the break with Russian gas

Launched in May 2022, REPowerEU laid out a clear path to decreasing dependence on Russian gas. It focused on three pillars:

- Voluntarily reduce gas demand.

- Diversify suppliers towards non-Russian sources.

- To promote the accelerated development of renewable energies.

The impact has been tangible. Between August 2022 and January 2025, gas demand in Europe fell by 17%, which is equivalent to about 70,000 million cubic meters per year. This reduction allowed strategic storages to fill up for three consecutive winters. In addition, it facilitated the phasing out of Russian gas without jeopardizing energy security or causing a prolonged price crisis.

To put it in context, Russian gas imports, which in 2021 were around 150 bcm (one billion cubic meters), fell to just 52 bcm in 2024. In relative terms, the share of Russian gas in the European mix rose from 45% to 19%. This figure is projected to fall further, to 13% by 2025.

This change responds to both the European political decision and the policy of the Kremlin, which cut off supplies through Nord Stream and drastically reduced shipments through Ukraine.

From the stable contract to the wild market: the new paradigm

The European gas supply system has undergone a profound transformation. In 2021, long-term contracts and domestic production accounted for more than 85% of total supply. Today, they barely reach 50%.

In parallel, exposure to the spot market and flexible LNG has grown from 15% to almost 50%. There are several reasons.

First, the uncertainty about future demand. The energy transition, electrification and decarbonisation policies make gas demand more difficult to predict.

Second, the fear of a possible return of Russian gas to the market. This could send prices plummeting and leave European buyers with long-term LNG contracts that prove costly and uncompetitive.

Third, environmental regulations, which are becoming more and more stringent. Methane emissions regulations add complexity to long-term contracts, making long-term commitments difficult.

But this model comes at a price. High exposure to the spot market makes Europe vulnerable to supply shocks and geopolitical tensions. The winter of 2022-2023 clearly evidenced this. Competition with Asia for LNG cargoes sent prices soaring, with the TTF exceeding €300/MWh.

Although prices stabilised in 2025 – €35.17/MWh in May compared to €58.14/MWh in February – the risk of episodes of high volatility remains latent.

A return commitment? The role of LNG and strategic alliances

Paradoxically, while Europe reduced its dependence on Russian piped gas, it did not strengthen the contracting of new long-term LNG contracts.

In 2024, European buyers signed less than 15% of global LNG contracts. Behind other blocs, such as Asia, which has opted for 15 to 25-year agreements with suppliers from the US, Qatar and Australia.

If this trend continues, spot exposure could reach two-thirds of European supply by 2030. This poses a direct threat to energy stability and economic competitiveness.

For this reason, the idea of rebalancing the portfolio with long-term contracts with strategic partners, such as the US, Norway, Qatar and North Africa, is gaining weight.

This strategy could combine:

- A base supply at a moderate and stable price.

- Flexibility to respond to the spot market when needed.

- Contractual clauses aligned with climate objectives, such as methane reduction and periodic review.

In addition, the production of renewable gases such as biomethane and biogas is booming. In 2023 alone, biomethane production reached 4,900 million cubic meters, and installed capacity exceeded 6,400 million. The goal is to reach 35 bcm per year by 2030.

This transition strengthens energy autonomy in the long term, although it requires considerable time and investment.

However, when it comes to global energy markets, few variables are as influential as U.S. policy decisions, and in particular, the phenomenon known as the “Trump effect.” This term, beyond referring to a person, symbolizes the volatility and unexpected shift in U.S. energy policies that can be unleashed with changes in the administration or political direction of the country.

Why does this matter so much for Europe? Because the United States is today the world’s leading exporter of liquefied natural gas (LNG), the pillar on which Europe has decided to base much of its future energy security, especially after the fall in Russian gas.

What is the “Trump effect”? In essence, it refers to the unpredictability and impact of energy and trade policy decisions driven by domestic and national interests in the U.S., which can rapidly alter the flow and prices of global LNG.

Under the Trump administration (2017-2021), mass production of domestic gas and oil was prioritized, tariffs were imposed, and protectionist policies were adopted that affected international energy trade. These movements generated uncertainty and tensions in energy markets that until then were considered relatively stable.

The Trump administration that began in 2025 has generated significant uncertainty in the global market for liquefied natural gas (LNG), fundamental to European energy strategy. With the imposition of high tariffs on imports and trade tensions with the European Union, coupled with ambiguous energy policies and reduced environmental regulations, the US has complicated European access to a stable and competitive supply of LNG. These measures have raised costs and increased market volatility, putting at risk the energy diversification that Europe seeks to leave behind its dependence on Russian gas.

Faced with this situation, Europe faces the challenge of strengthening its energy autonomy by diversifying suppliers, investing in renewable energies and building more stable and balanced trade relations. Only with a solid and flexible strategy will it be able to mitigate the impacts of US political volatility and ensure a secure and affordable supply of gas for its energy transition.

How can this uncertainty affect Europe today?

- Volatile trade policy: The U.S. may decide to impose tariffs or restrictions on LNG exports to protect its domestic market, raise prices, or favor different geopolitical interests. This can make LNG more expensive for Europe or reduce its availability.

- Changes in subsidies and regulations: Sudden modifications in support for the gas industry, environmental constraints or changes in taxation can slow down investments in new liquefaction or export plants, limiting the future supply of LNG.

- Prioritizing the domestic market: In situations of shortages or internal crises, the US could prioritise its own supply over exports, leaving Europe in a vulnerable position in the face of growing dependence on LNG.

- Geopolitical uncertainty and alignments: Strategic alliances can change rapidly, affecting contracts and supply agreements. Competition with Asia, coupled with potential domestic turbulence in the U.S., may cause markets to become unpredictable.

Implications for the European strategy

Europe, which has already increased its exposure to the spot market and flexible LNG, faces a scenario in which the US supply – its main ally in this transition – may fluctuate for political reasons unrelated to market logic.

This risk adds pressure for the EU to further diversify its suppliers and not rely exclusively on U.S. LNG. In addition, it underscores the urgency of building long-term contracts that include stability clauses and mitigation mechanisms in the event of political or commercial disruptions.

What can Europe do?

- Strengthen alliances multilaterally: Not depend only on the US, but also promote strong relationships with Norway, North Africa, Qatar and new emerging producers.

- Boost the domestic market and renewables: Reduce net gas demand, increasing storage capacity and energy efficiency.

- Develop risk mitigation strategies: Guarantee funds, flexible bilateral agreements, and diversification of routes and technologies.

Although the official position of the European Union and most of its member states has been to close the doors to any negotiations to reactivate Russian gas flows, the current geopolitical and energy context invites us to reflect pragmatically.

On the one hand, maintaining the rejection responds to key objectives: to sanction Russian aggression, to avoid dependence on a supplier whose policy is perceived as an instrument of pressure, and to accelerate the transition to renewable energies and energy autonomy (the pillars of REPowerEU). Giving in on this point could be interpreted as a political weakening and a strategic contradiction, as well as potentially slowing down the energy transformation.

On the other hand, the increasing volatility of the global LNG market, the “Trump effect” and uncertainty about the security and stability of alternative supply pose a complex scenario. Europe must ensure reliable supplies and competitive prices to sustain its economy and avoid energy crises. In this sense, opening a limited and well-conditioned channel of negotiation with Russia could offer a lever to mitigate risks in the short and medium term, without renouncing the long-term vision.

In short, it is not so much a question of choosing between reopening or closing negotiations, but of designing a flexible and contingent policy that integrates sanctions and pressures with strategic energy security options. This flexibility would allow Europe to better manage uncertainty without losing sight of the climate and geopolitical ambition defined by REPowerEU.

Conclusion: building resilience beyond the current situation

Europe has shown that it can reduce its energy dependence on Russia without paralyzing its economic system. But this feat was based on short-term decisions, high exposure to the spot market and a certain climatic fortune.

Looking ahead, it is essential to consolidate a balanced energy strategy. A mix is needed that combines long-term contracts that provide stability and sufficient flexibility to adapt to uncertainty.

In addition, strengthening strategic alliances, accelerating the production of renewable gases and maintaining energy efficiency as a fundamental pillar.

In short, Europe must move beyond the “overnight adventures” in the spot market and commit to long-lasting and strategic energy relations. Only in this way will it be able to guarantee real autonomy, resilience and sustainability for the future.

Alejandro de Roca | Director de Mercados y Operaciones

If you found it interesting, please share it!

Recent Articles