As some Magnus followers already know, every week we take the chance to share our knowledge by writing interesting articles about energy. Our experience and global knowledge comes from years helping big international companies to define and execute energy strategies. By taking the daily pulse of markets with our customers to take the righ decisions.

However, full in the budgeting period and coinciding with the return of summer vacations all alarms have been triggered. After 4 years in which an acceptable purchasing strategy has allowed continuous price improvements, we face a bullish 2017 and 2018 purchases with important increases.

The market seems to have gone mad and has no roof. Brent is already reaching $ 60 / bbl, coal is approaching $ 90 / t, emission rights are leaping, and electric and gas markets are rising with determination within the last two months. How far will the markets go?

WHAT IS GOING ON?

It is inevitable to take as a reference the markets situation in the first quarter of 2016. In that period the crude oil market as of almost all commodities sank to historic lows not seen in the last 8 years. This situation invited the most enthusiastic to think about a definitive “cheap” energy markets.

However, the market began to rise timidly in the second half of 2016 to continue its climb (beyond specific milestones) throughout 2017. But let’s analyze the reasons.

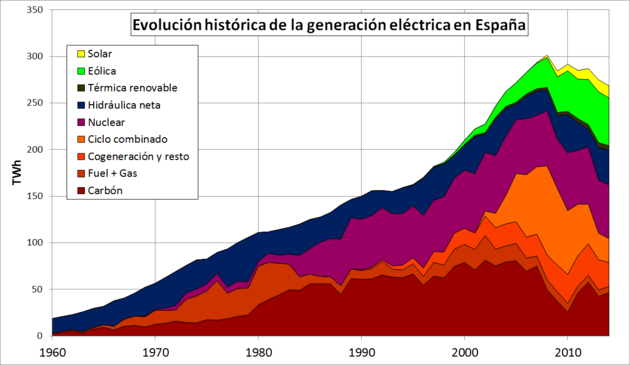

Let’s focus on the Spanish power market. We have already talked more than once about the evolution of the electricity generation mix in Spain and we are not going to extend it again. However, it is necessary to know it before going in to detail with the current situation.

In short, our electricity depends on:

- Nuclear availability (both national and interconnection).

- Cogeneration and combined cycles (Gas).

- Coal

- Emission rights (CO2)

- Hydraulic generation (storable renewable)

- Wind and solar generation (non-storable renewables)

That is to say, we depend on water levels in the hydraulic national reservoirs, on the meteorology, but mainly on the nuclear power availability and the prices of the fuels consumed for power generation.

CRUDE OIL

Let’s start with crude oil (for being the global energy reference and helps us to understand the global sentiment). The price of oil has doubled in one year. The entry of the American Shale-oil drove prices down to prices not seen since 2008 and greatly displeasing the markets and especially the Organization of Petroleum Exporting Countries (OPEC) that has already assumed the loss of market control. They still remain an important part of the production, but not the most one. Since 2016 OPEC have tried to balance supply and demand to raise prices. Only an agreement in extremis between OPEC countries, Russia and Mexico together with the recovery of the global demand are holding this increase. OPEC continues to extend the cut-off agreement (1.8 million barrels per day) to bring the market to where it is most profitable. Is it sustainable agreement? There are many doubts about it.

CO2 EUROPEAN EMISSION ALLOWANCES

The European emission rights market has been at a level price that barely managed to exceed 4 euros per ton. Let’s remember that Europe launched the emission rights market to penalize electricity generation based on the consumption of fossil fuels and promote environmental objectives. The higher the emission rights prices, the more expensive it is to generate with commodities such as coal.

The EUA market with a known excessive offer has facilitated the collapse of prices and therefore been considered as a failed system to achieve the climatic objectives. In recent months concern about environmental impact has returned to political discourse. We are on the verge of 2020 and everything indicates that Europe will not meet the environmental objectives. As a result of a bad planning the solution seems to come with “last minute” drastic decisions. A few weeks ago Germany and France declared their interest in facing a reform in this market with their willingness to adopt land value (as they have in the UK). This would imply a generalized rise in the prices of electricity markets that require these permits. Only those statements triggered a jump in the market and it seems that what is an intention, can lead to a new standard. Will they establish a soil value? What value will be allocated? … € 10 / t, € 20 / t? …

COAL

It is the market that in the last year has shown with more determination its upward trend. Europe continues to depend heavily on this fossil fuel and this exposes us to the ups and downs of the main global producers (Indonesia) and consumers (China). Precisely China is one of the main actors for the continuous increase in prices. Despite reducing its local production, it keeps consuming a lot. Moreover, low emission allowances have made it easier for countries like Germany or Poland to consume coal to produce competitive power. Now we’re on the way to $ 90 / ton … Where is the roof? Have we reached it?

GAS

The gas market has been the main protagonist in recent years. The rise of LNG has facilitated the flow of gas outside the limits of the pipeline grid. Forcing to reconsider the fundamentals of such market. However, despite of the numerous regasification plants in Europe (especially in Spain) and the important levels of storage, the price has not ceased to climb. The answer lies in the thrust of its substitute fuel (coal). The rise of coal prices has led to switch to gas-power plants production and therefore increasing gas demand. The higher the coal, the greater the demand for natural gas.

RENEWABLE ENERGY

Hydraulic renewable generation is one of the pillars to contain power prices in European markets. Especially the southern ones. Spain is going through a long period of low rainfall and widespread drought. Given the unavailability of such technology, we are more exposed to other sources of power generation.

Renewable generation (wind, solar, etc.) is still very important but its predictability does not make it the best of allies in the face of the generalized rise in commodity prices. While it is fair to say that they help contain the prices.

NUCLEAR ENERGY

National and international nuclear generation. The technology generation more discussed but the one that in the end assures us a reliable and at a good price electricity. Right now, the competitiveness of our market lies in the availability of nuclear generation. Despite the definitive closure of Garoña (already in 2012) and the uncertainty of Iberian nuclear plants in the near future, there have been no relevant incidents. However, we have been suffering the unavailability of the French nuclear power during 2017, it seems that the problem will remain in the coming months. In the end, all neighboring European power markets relay on the nuclear French generation when their domestic markets reach high prices.

When the French nuclear generation suffers continuous unplanned cuts, we are left without an important back up. This is what has been happening in recent months. Keep an eye on the French market…

The result has been a generalized rise in European electricity prices.

The entry of new sources of generation in the mix and its lack of predictability has led to an increasingly volatile spot market that hampers price forecasting models and carries an increasing risk.

This situation emphasizes the importance of having a clear purchasing strategy in the energy field. I have been in the industry for years and there is always the temptation to create expectations and hopes about where the markets can go. But as we have seen, this would mean having the ability to forecast macroeconomic, political, meteorological data, etc … Little less than impossible. Are you a decision maker or you just let the market to decide for you? Do you know what big companies are doing?

Companies must be aware of the possible negative consequences of getting carried away by the promises of expected market improvements. Consult specialists, read … This will not allow you to see the future, but to protect your company from milestones and / or threats to make the best decisions by managing the risks. and do not trust market futurists. Do not trust market futurists…

Alejandor De Roca | Energy Consultant

If you found it interesting, please share it!

Recent Articles