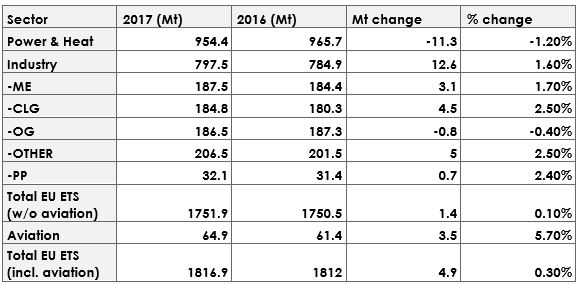

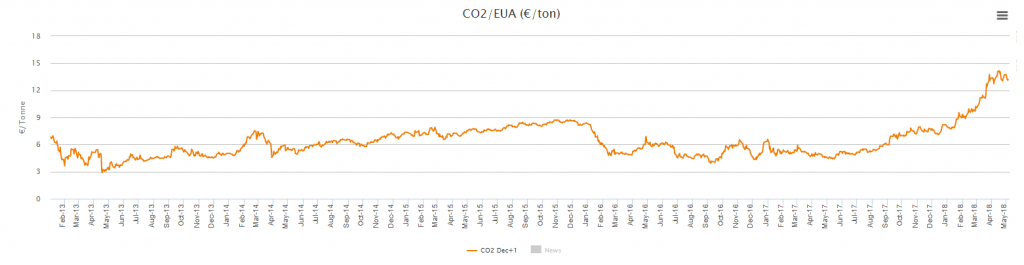

The carbon emission rights of the European emission trading system (EU-ETS, for its acronym in English) have gone up in price by 60% since last January and have tripled since May last year when they cost 4.38 euros/ton, up to 13.82 euros in April of this year. Following the data of the European Commission released this past Tuesday, the regulated emissions in the European market of rights of emission of carbon dioxide (CO2) rose in 2017 for the first time in seven years due to the greater industrial production. Total issues of the Emissions Market System have risen 0.3% in 2017, from 1,750 million tons in 2016 to 1,756 in 2017. This means the first increase since 2010.

There is a decrease of 11.7 million tons in energy and heat emissions compared to 2016. The emissions of the European electricity sector continue a downward trend as renewable generation grows and countries move away from coal. What’s more, if the nuclear cuts of last year in France and the drought in southern Europe had not happened, the demand for fossil fuel plants would not have increased, and energy emissions could have decreased by another 20 million tons in line with this trend.

In fact, due to the incident known as “perfect storm”, where the French nuclear park had problems, water reserves were low and temperatures also, Spain was the fourth country in the European Union (EU) that increased its emissions the most of C02 in 2017. According to data published this past Friday by the European statistical office Eurostat, Spain increased 7.4% more C02 emissions compared to 2016 and represented 7.7% of total C02 emissions from the EU block, the sixth greater proportion.

However, the European economy grew by 2.5% last year, and in the case of Spain by 3.1%. The strong growth in the European economy resulted in higher activity that led to higher emissions. The emissions in the industry sectors increased a total of 12.6 Mt or 1.6% with respect to 2016, with the highest increase observed in the ‘Cement of lime and glass’ sector and the ‘Other’ sector.

In general, the decrease in emissions in the energy sector was overshadowed by growth in industry sectors and resulted in a 1.8% increase in emissions from.

C02 of the EU with respect to 2016. An increase in C02 emissions having almost the same number of ETS issued as in 2016.

THE MARKET SYSTEM FOR CO2 EMISSION RIGHTS

Nearly 45 percent of the European Union’s greenhouse gas production is regulated under the Emissions Rights Trade Regime (ETS), the main tool of the country block to address global warming by charging duties to emit CO2.

The Emissions Market System (ETS) controls 11,000 industrial facilities in 28 member countries, as well as Iceland, Liechtenstein and Norway. Among the facilities that control are the power plants, the cement industry, the steel industry, the refineries and the aviation sector for flights arriving or leaving the EU. In the EU, 70% of emissions come from the energy sector and the rest correspond to the other three sectors in almost equal parts. In Spain, 50% corresponds to the energy sector, that is, to electricity production, and the other half to the other sectors.

The ETS system is governed by the law of demand and supply. On the one hand, the offer is fixed and take place in auctions. It is a peculiar offer because for almost all sectors except the electric CO2 emission rights are free allocation. On the other hand, the demand is made up of the companies that request the emission rights to cover their emissions. An emission right corresponds to a one cost per ton. To get an idea of the need, the conversion ratios in coal and gas can be around 0.92 TC02 / MWh and 0.28-0.37 TC02 / MWh respectively (the higher the energy efficiency, the lower the ratio). Therefore, the demand for rights will depend on the needs of the companies. If there are enough or lack of acquiring rights depending on the activity, the companies that own the facilities can go to a secondary market where they can buy or sell CO2 emission rights among themselves.

If the needs of companies increase, the demand rises and the price also increases. Therefore, one might think that the fact that the price has risen is due to an increase in industrial emissions due to the recovery of activity after the crisis in a market where supply is fixed. Is it only economic reactivation the reason for the increase in the price of C02 emissions rights?

THE FOURTH PHASE AND THE MARKET STABILITY RESERVE

When the emission rights system was structured, it was based on a demand for energy in perpetual expansion and therefore a growing need for emission rights. This determined that the model was based on the allocation of a fixed amount of emission rights in a market in which the emission generation rate is variable.

The operation of the ETS market was not contemplated in an environment of international crisis that led to a collapse in the generation of C02 emissions. The EU was faced with a system that did not bear fruit to respond to the decarbonization of the Kyoto agreement economy, since the price was in free fall during the years of the crisis, among other things due to an accumulation of a large surplus of emission rights in the system (and industrial production was lacking).

For emission rights to have a dissuasive effect on the generation of greenhouse gases by industry and energy generating companies, these rights must have a minimum market price. A price that did not occur in Europe after the crisis. It is believed that at a price of € 20-30 / t, clean technologies will be more competitive. Meanwhile, it is sought to provoke in the energy sector that the “C02 Switching Price” favors the burning of gas before the coal in thermal power plants, since coal is about 2.5 times more polluting than natural gas. The “Co2 Switching Price” is the reference price of CO2 that indicates when a change from coal to natural gas or vice versa is economically advantageous for an electric power producer. The reference price implies that both the “Clean Dark Spread (CDS)” and the “Clean Spark Spread (CSS)” would have the same value € / MWh. Mention that if the cost of the C02 emissions rights is taken into account, the CDS is the gross margin of an electric power plant by burning coal in the sale of 1 unit of electricity (€ / MWh and the CSS is the same but with the gas.

For this reason, the European Commission (EC) reacted with short-term measures and long-term decisions. The short-term measures have meant suspending the allocation of 900 million emission rights between 2014 and 2016 until January 2019. At the end of 2016, the excess of emission rights was 1,700 million tons while the total demand of the companies European Union is of the order of 1,750 million tons. As of January 2019, instead of awarding the 900 million accumulated rights in the market, these will be incorporated into a Market Stability Reserve (MSR). These and other measures are part of the fourth phase of the ETS market to meet the action objectives against climate change and reduce C02 emissions by 40% by 2030.

The MSR is a non-discretionary mechanism that regulates the quantity of auctions in the European carbon market. The basis for the operation of the MSR is the market surplus resulting from the official estimate of the total number of emission allowances in circulation for the previous year (x-1) made by the Commission every May 15 of each year (year). The MSR system aims to act as a market regulator to the extent that the allocation of emission rights is fixed while the generation of emissions is variable:

- Rules for the retention of rights: If the published number of emission rights in circulation exceeds 833 million tons, 24% of that amount will be withheld from scheduled auctions from September 1 of year x through August 31 of year x + 1. From 2024 onwards, the withdrawal rate will be 12%.

- Rules for the release of rights: If the published number of emission rights in circulation is less than 400 million tons, 100 million rights will be released in scheduled auctions from September 1 of year x through August 31 of year x + 1. If the amount of permits in the reserve is less than 100 Mt, all permits will be released.

It is expected that the start-up of the ETS market in this fourth phase will involve the draining of surpluses from the market at a rate of 24% per year between 2019 and 2023 and at a rate of 12% per year thereafter ,that is, that the retention rules are activated. To this perspective of massive reduction is joined the agreement that took place between the European Parliament and the council to strengthen the system even more at the end of 2017:

- An acceleration was agreed in the progressive reduction of emission rights of 2.2% per year instead of 1.74%, which implies a withdrawal of 556 million rights. That is to say, to the 900 million retained are added 556 million less in circulation.

- It was decided to reduce the number of free-of-charge allocation rights per entity as a considerable number of free allocations will be reserved for new growing facilities.

Last but not least, remember that in 2014 the new Directive on the markets of financial instruments (hereinafter MiFID II) deals with the rights of C02 emissions as financial instruments, opening the door to other agents in the market like the banks and investment funds that invest in the medium and long term. New agents who take positions taking into account that European policy is firmly committed to the decarbonisation of the economy.

Therefore, the elements that pushed the price of C02 emissions rights to 60% higher than last year are: anticipation of greater rigidity in the market since the industry will not be willing to sell, the realization that the MSR is approaching and a current safe policy of strengthening the ETS system; new participants in the EU carbon market and the ‘Headline-trading’ by speculators related to several events that were already there.

Summing up, the price of emission rights rose these past months not only due to the usual seasonal purchase of emission rights that occurs in April for companies to cover their C02 emissions with respect to the previous year, but also for:

- Higher demand due to the recovery of industrial activity, and less sale by the industry of its C02 emission rights.

- The regulatory novelties approved by the EU at the end of last year to tackle the oversupply with the MSR.

- The greater purchase of ETS by new players in long-term positions that reduces the available supply.

A price of emissions rights of C02 high that directly affects the price of daily and future electricity. According to the ratios of conversion of coal (0.92 TC02 / MWh) and gas (0.28-0.37 TC02 / MWh) respectively and a rise of € 15 / t could mean an increase in the productive cost of these technologies of around € 14.4 / MWh and 5.5 € / MWh. Already the continuous penetration of renewables has reduced the operating margins of coal burning plants, probably forcing the least efficient to disconnect from the network. We hope that the rise in the price of CO2 emission rights will encourage a faster change from coal to gas or we will see a very high price of electricity in the coming years.

Marta Merodio | Energy Consultant

If you found it interesting, please share it!

Recent Articles