Like all other markets, natural gas moves upwards when there are more buyers than sellers in the market and moves downwards when the opposite happens. The tough world of “intuitive” operations has been back on its head again last week. The fundamentals, technical analyses and any other form of analysis that we are used to, come to nothing when something unexpected happens.

A huge cold spell triggered by a rare weather event over the Arctic has put the gas markets to the test last week. This happened, on a background of rising price rises and low storage levels in certain countries, as it is common during this time of the year.

The culprit has been the phenomenon called “The Beast of the East”, which has caused temperatures in Europe to reach -12 degrees Celsius, breaking records of snowfall intensity that did not happened during the past 30 years. This led to tense operations and possible shortages, given that the demand for the system reached a maximum of 10 years last Wednesday in some European cities.

On the import side through Nord Stream and Yamal-Europe to north-west Europe, transit remained at peak capacity levels. In fact, Gazprom admitted having broken historical records for eight consecutive days.

Was this enough for prices to triple overnight?

To know the answer, let’s look at the detail by area:

UK

Increasingly dependent on the rest of Europe following the loss of the Rough field (a topic we faced some time ago in the M-Blog) gas prices in the UK have been strained, with only seven mid-range facilities available during the period of high demand. This led spot prices to reach levels not seen during the past 20 years.

Following the punctual unavailability of gas and in order to restore normal levels of supply to some extent, two shipments of LNG from Russia were requested which have been crucial for price correction.

Norway

The second largest gas supplier in Europe suffered an unplanned disruption at the Kollsnes plant on 1 March, which limited exports via the Langeled pipeline from Norway to the UK.

Netherlands

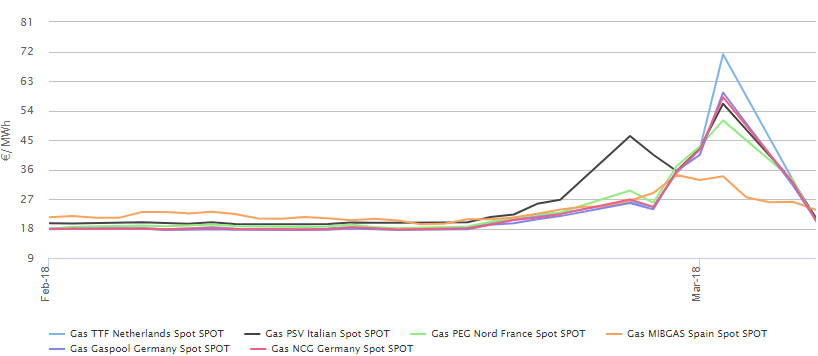

The TTF reference reached values of 120€/MWh in intraday and closed above 70€/MWh on March 2nd. Motivated by the abrupt increase in storage withdrawals from 41mcm/day to almost 200 in one day.

The Netherlands increased imports from Germany by 50 per cent to meet its domestic demand and counteract the loss of production.

Germany

The more expensive prices of the TTF made it no longer attractive for the Germans to purchase gas in the Dutch market. As a result, imports from the Netherlands decreased by three quarters and storage withdrawals increased considerably.

The temperatures in the country that consumes most gas in Europe were mild compared to the previous days, which leads to think that prices were highly influenced mostly by what was happening in the neighbouring markets rather than by their own fundamentals.

France

In France, the gas operator had problems balancing the network system in the north of the country. In fact, they reached alertness in certain hours. At the expense of an LNG tanker at the northern terminal in Montnoir and unable to acquired Dutch gas, prices of Peg Nord and TRS skyrocketed.

Belgium

Dragged by the rest of the markets, the referent Zeebrugge also traded at high prices. Prices were pressured, in addition to the factors discussed above, by the situation in the country’s only storage depot (Loenhout).

Italy

Climate-driven demand exposed the system to a severe shortage of supply as imports and available extraction capacity from storages was not enough to meet consumption needs.

Despite the LNG shipment, supply in northern Europe was constrained by soaring prices in the other hubs, which made it difficult to cover the costs of short-term gas imports from Switzerland.

Spain

Given the situation in the rest of the countries and in contrast to price stability in Spain, the country became a physical gas exporter of 20 million cubic meters per day connecting the Spanish PVB (Virtual Balance Point) market with the TRS zone in southern France. While the remaining hubs tripled their prices, in Spain the price did not exceed 34€/MWh.

After the climb, everything’s back to normal?

During the tensest days, carriers removed gas from European stores at a speed of almost 780 million cubic meters per day (mcm). If the extraction rate had continued at this level until the end of the month, the storage tanks would have reached reserve levels well before the end of the month.

Natural gas in Europe is entering an important time of year, as withdrawals from inventories will be converted into injections as the peak demand season comes to an end.

Usually storage levels are lower at this time of the year, since their evolution depends on how temperatures fluctuate during the remaining days of winter. And depending on how it evolves, the period of injection will begin, the aim of which is to comply with one of the premises of European energy policies: security of supply. Injection is expected to start earlier this year than usual. Last year it was brought forward, and it started on March 28th.

When incidents of this kind occur, we see how vulnerable markets are to extreme events. Since the alternative to natural gas is LNG (Liquefied Natural Gas) which is not available in the short term, for the time of arrival and unloading of the ship itself, so it cannot be used to curb the volatility of spot prices at any given time.

Being part of a continent that is highly dependent on natural resources obliges us to have at our disposal tools that help us to deal with this type of event, investing for example in interconnections, if these were greater between Spain and France, we would have been able to alleviate the price tension at least in France. Especially if we want to invest in Europe’s objectives in the field of energy: security of supply, competitiveness and sustainability.

Sonia Díaz | Energy Consultant

If you found it interesting, please share it!

Recent Articles