To understand the recent application of the Carbon Cap and Trade Mechanism (CBAM), we must go back to the creation of the EU Emissions Trading Scheme (ETS), which set a cap on greenhouse gas emissions. An auction market was created to purchase these allowances by the industry involved. Free allowances were also created for industry to avoid “Carbon Leakage”, an important concept. You can read the Current EU Emissions Trading Scheme Scenario for further information.

But the dilemma of balancing competitiveness with Energy Transition arose within the European Commission: how to achieve the objectives set out in the “Fit for 55”, and compete with third countries that have more lax environmental policies? And furthermore, how to prevent the mentioned “Carbon Leakage”, that is to avoid the relocation of European industry in search of less stringent countries.

These were the reasons that led the European Commission to present a proposal for the CBAM on 14 July 2021, and which has finally been implemented, on a transitional basis, as of 1 October 2023.

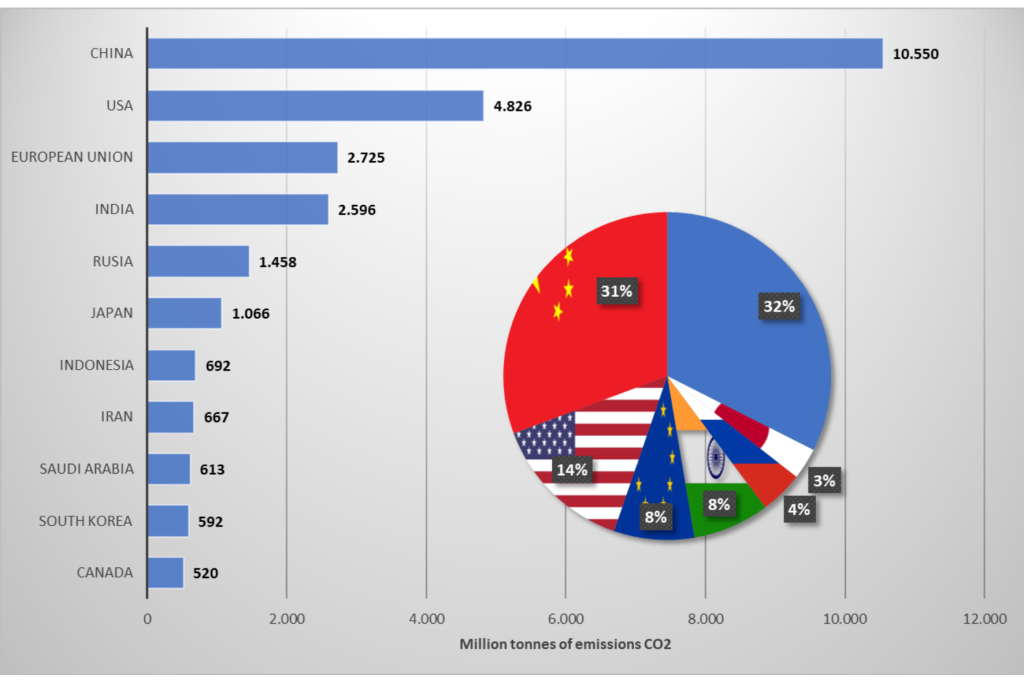

Image 1: Ranking of countries with the highest CO2 volume in 2022 (million tonnes)

Source: Statistical Review of World Energy 2023

How does CBAM work?

First, it is necessary to clarify which imports into the EU will be affected by the CBAM. Initially it will apply to imports of goods whose production directly or indirectly emits greenhouse gases, as follows:

- Cement

- Iron & steel

- Aluminium

- Fertilisers

- Electricity

- Hydrogen

Thus, with this scope, the CBAM will capture more than 50% of the emissions from the sectors covered by the ETS.

During a first transitional phase or pilot test, importers of goods will only have to report the greenhouse gas emissions embodied in their imports without making any payment or financial adjustment. Indirect emissions will be included in the scope after the transitional period for some sectors (cement and fertilizers), based on a methodology to be defined during this pilot test.

The CBAM Regulation entered into force on 16 May 2023, the day after its publication in the Official Journal of the EU. From 1 October 2023 until 31 December 2025, it applies on a transitional basis. The first declaration period for importers will end on 31 January 2024, but it will not be until 2026 that importers will start paying for their imports. This phasing-in of the CBAM is done in parallel to the reduction of free ETS allowances, thus avoiding Carbon Leakage and supporting the competitiveness of companies established within the EU.

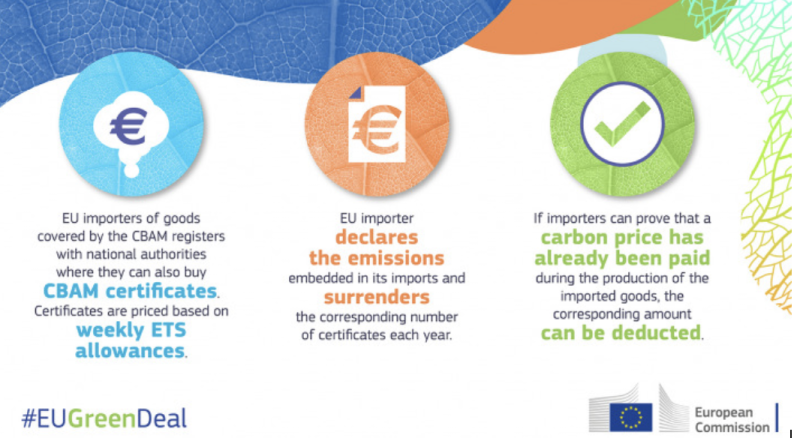

After the end of the transitional period, importers will have to declare each year the quantity of goods imported into the EU in the previous year and their embodied greenhouse gases. A corresponding number of CBAM certificates will then be issued. The price of these certificates will be calculated based on the average weekly auction price of EU ETS allowances expressed in €/tonne of CO2 emitted.

Image 2: Outline of the CBAM process for importers

Source: Taxation and Customs Union

UE vs rest of world

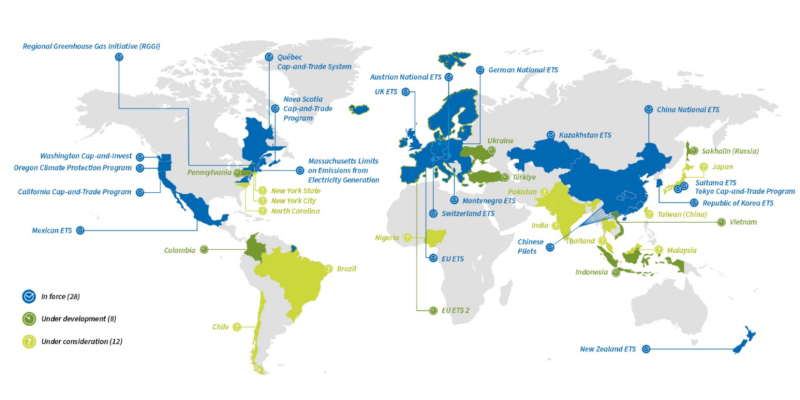

The main emission trading systems, by volume, in the world are:

- European Union Emissions Trading Scheme (EU-ETS)

- Korean Emissions Trading System (KETS)

- California Cap and Trade Programme

- Regional Greenhouse Gas Initiative (RGGI), Northeastern US states.

- China’s National Emissions Trading System (China-ETS)

Other countries are either developing their own emissions trading systems or are considering implementing them.

Image 3: Map of countries with ETSs in place or under development

Source: International Carbon Action Partnership

The European Union must compete without a level playing field, since there are countries exporting products such as Brazil, India, regions of Japan or the USA, which do not yet have systems in place, and these are precisely the most polluting countries. This is a major drawback for European industrial competitiveness.

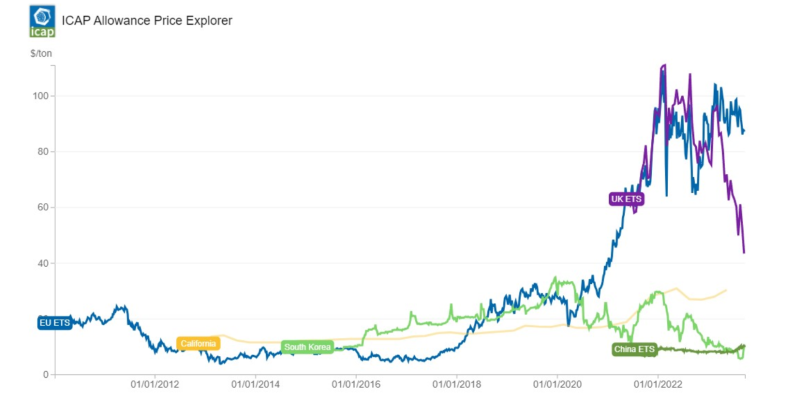

Furthermore, if we look at the countries or regions that already have emissions trading systems in place, and the evolution of their prices, we see large differences in the price quotation, a fact that aggravates the EU’s competitiveness problem. While the current price in the EU is around 80 $/t, the closest market is the UK market at around 40 $/t. The Californian market is quoted at around 40 $/t. The Californian market is quoted at around 30 $/t, and the South Korean and Chinese markets at around 10 $/t.

Image 4: Price developments in the main ETS markets

Source: International Carbon Action Partnership

Given this situation, it became essential for the EU to take measures to prevent carbon leakage, and therefore the relocation of the industry affected by the emission allowances. In fact, the UK is also planning to implement a border tax similar to that of the EU from 2026.

But obviously the responses from the countries directly affected have not been long in coming. China has already expressed its concern that this mechanism does not comply with WTO rules, nor with the Paris Agreement, arguing that it attacks free trade, damaging global supply chains. In the steel sector alone, where China is the fourth largest importer to the EU, it would have an impact of 4-6% ($200m-$400m). Other countries such as India are considering complaints to the WTO and are even considering applying an EU-specific carbon tax to repatriate losses that would otherwise be passed on to the EU. With 27 per cent of India’s steel, iron and aluminium exported to the EU, the impact on Indian companies will also be significant. The most critical voices argue that these measures end up affecting the countries with the least economic resources, which have contributed the least to climate change, and therefore attack the foundations of a just transition. In response to these accusations, EU trade chief Valdis Dombrovskis said that the European Commission has carefully designed the scheme to be compatible with WTO rules, applying the same carbon price to imported goods as to EU domestic producers. Even so, the countries concerned, with China in the lead, want to establish talks within the WTO to homogenize this type of measure before other developed economies such as the US or the UK implement similar mechanisms and further damage their exports, and thus their economies

If you found it interesting, please share it!

Recent Articles