The EU Emissions Trading System (ETS) is currently in its fourth phase (2021-2030) since its inception in 2005 and covers approximately 45% of the EU’s greenhouse gas emissions. The EU ETS is undoubtedly a key element in achieving the climate targets for 2030 and 2050. After nearly two years of negotiations, EU lawmakers reached a provisional agreement on the reform of the EU ETS in December 2022 as part of the “Fit-for-55” climate policy package. The objective is to align the system with the goal of reducing the EU’s net greenhouse gas emissions by 55% by 2030, compared to 1990 levels.

Since the start of this new phase in 2021, European Union Allowances (EUAs) have seen their prices increase from values of €30-40/ton to reaching €100/ton on two occasions under high volatility. One of the main bullish fundamentals has been the progressive adoption of the EU ETS reform measures.

What are the new mechanisms and objectives that the new EU ETS faces?

The reform of the ongoing Phase 4 of the EU ETS consists of five main elements:

- A reduced cap and a more ambitious linear reduction factor for greenhouse gas emissions.

- Revised rules for the free allocation of emission allowances and the Market Stability Reserva (MSR)

- Extension of the ETS to maritime transport.

- A new separate ETS for buildings and road transport.

- Increase in Innovation and Modernization Funds and new rules on the use of ETS revenues.

Changes in the MSR and LRF

As a long-term solution and structural reform of the Emissions Trading System, the EU implemented the Market Stability Reserve (MSR) in January 2019. The Market Stability Reserve withdraws a portion of the excess allowances from the market annually. In case of a deficit or a very small surplus, it can transfer allowances back from the reserve to the market. Before May 15, the European Commission (EC) publishes the number of emission allowances in circulation from the previous year. If this number exceeds 833 million, 24% of the allowances are transferred to the MSR. It was planned that, starting from 2024, the percentage of surplus allowances transferred to the MSR would be reduced to 12%. However, the European Parliament, in line with the commitment of its “Fit for 55” package, approved an annual extension of the 24% withdrawal from the MSR until 2030 in April 2022. This ensures a rapid withdrawal of surplus allowances and ensures that the EU carbon market can withstand economic impacts and maintain a sufficiently high carbon price to meet decarbonization goals. Similarly, the price control mechanism was approved to automatically release 75 million allowances from the MSR if, for more than six months, the average price of EUAs is above 2.4 times the average of the previous two years. This multiple of 2.4x is less restrictive than the previously proposed multiple of 2x and is less likely to be activated, meaning that the MSR is more likely to retain supply rather than add it.

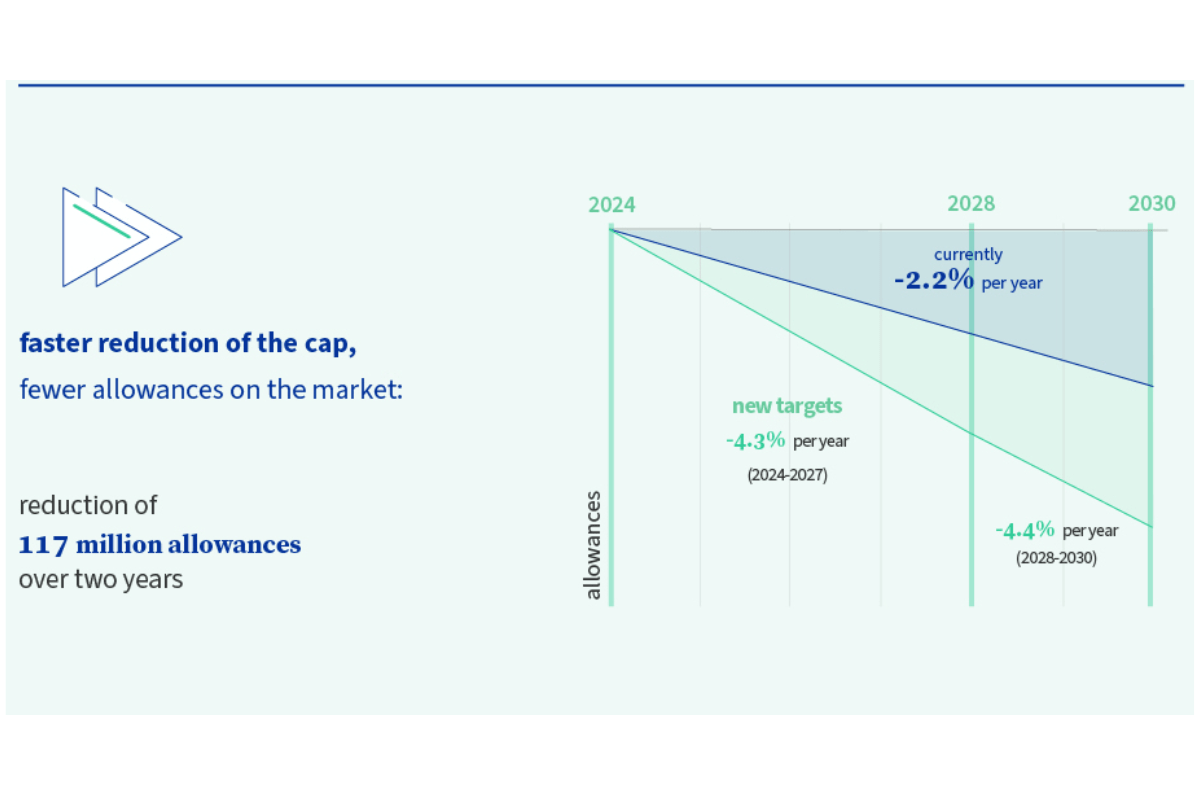

On the other hand, the reform of the EU ETS implements changes in the Linear Reduction Factor (LRF). This factor corresponds to the systematic reduction of allowances issued in auctions. In Phase III, it was 1.74%, and in Phase IV (current), it is 2.2%. The reform contemplates increasing the annual reduction in two stages: a reduction of 4.3% from 2024 to 2027 and 4.4% from 2028 to 2030. By reducing the cap at a faster rate, a reduction in supply is generated, which should be bullish for EUA prices.

Source: European Parliament

The main objective of this reform is for the 10,000 installations covered by the ETS to reduce their carbon emissions by 62% compared to 2005 levels by 2030, which is considerably higher than the current target of 43%.

Gradual elimination of free allowances and the implementation of the CBAM

The ETS applies to all greenhouse gas emissions generated by electricity production, intensive industry, and civil aviation within the EU, Iceland, Liechtenstein, and Norway. This covers approximately 45% of the EU’s greenhouse gas emissions (CO2, N2O, and PFC).

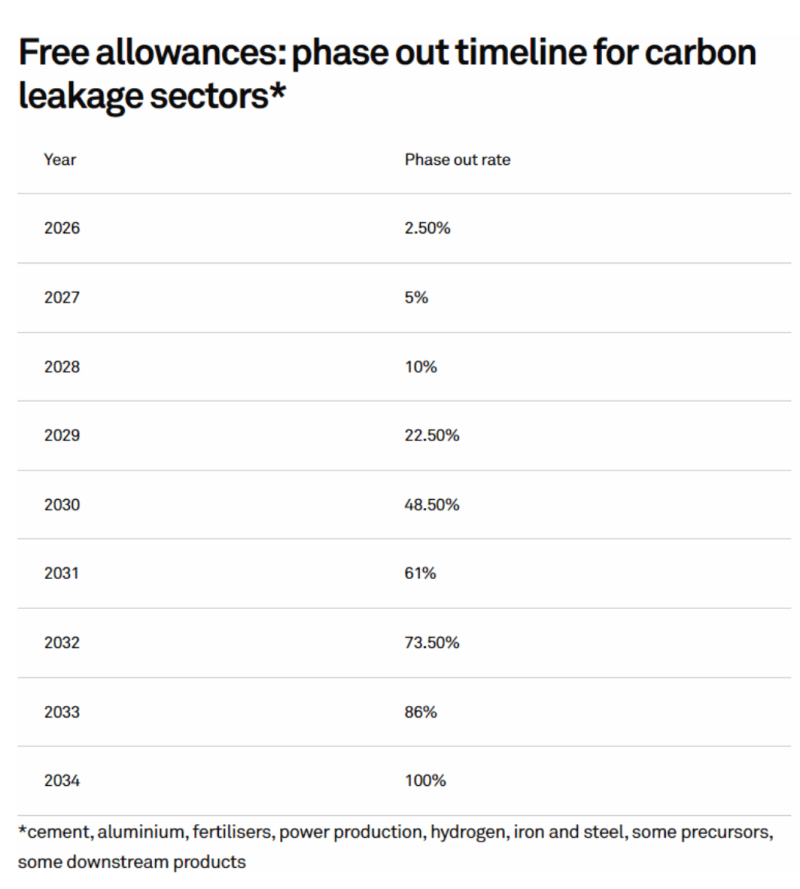

In Phase III, 57% of the allowances were auctioned, while the remainder were free allowances. Most of the market, approximately 94% of industrial emissions, is covered by free allowances. The reform of the EU ETS outlines the gradual elimination of free EUA allowances starting in 2026 with a rate of 2.5%, which will progressively increase over the years until free allowances are completely phased out by 2034. The timeline for the gradual elimination is as follows:

Source: European Parliament and S&P Global Commodity Insights

Even with lower rates in the short term, this elimination of free allowances will continue to have a bullish impact on the market. Limiting free allowances, along with the annual emission limit reduction rate, will have a significant market-adjusting effect. It will also provide room for generating higher auction revenues, which can then be directed towards innovative decarbonization projects.

This gradual elimination of free carbon allowances allows for the introduction of the Carbon Border Adjustment Mechanism (CBAM). This mechanism acts as a tariff on foreign companies by requiring energy-intensive producers to pay the EUA price on goods imported into the region. The CBAM is highly significant because it will prevent carbon leakage by establishing a more equitable competition between borders and replacing free emission allowances. By 2025, the EC will assess the risk of carbon leakage for goods produced in the EU intended for export to non-EU countries. Additionally, around 47.5 million EUAs will be used to raise new funds to address any export-related carbon leakage risks.

Maritime Transport, Buildings, and Transportation

The reform of the EU ETS includes emissions from maritime transport within the emissions trading system, with the obligation for shipping companies to surrender allowances for 40% of verified emissions starting in 2024, 70% by 2025, and 100% by 2026. This inclusion of maritime sector emissions can have bullish effects on the market by introducing new dynamics of supply and demand. Most large vessels would be included in the EU ETS from the outset, while offshore vessels with a gross tonnage exceeding 5,000 tons will be covered by the EU MRV Regulation (monitoring, reporting, and verification of CO2 emissions) from 2025 and the EU ETS from 2027.

Additionally, a new independent “ETS II” introduces carbon pricing in buildings and road transport starting in 2027. While the current EU ETS covers emissions from energy, industry, and aviation, this new system will regulate emissions from public and private road transport as well as building heating emissions. The ETS II will operate independently of the main EU ETS, although they may be combined in the future to establish a single carbon price. Overall, these expansions of the EU ETS and the inclusion of new sectors and emission sources are expected to contribute to covering approximately 75% of the EU’s total emissions by 2030.

Innovation and Modernization Funds

The Innovation Fund is the EU’s fund for climate policy, with a focus on energy and industry. Its goal is to bring market-ready solutions for decarbonizing European industry and supporting its transition to climate neutrality while fostering its competitiveness. The EU ETS provides the revenues for the Innovation Fund through the monetization of 530 million EU ETS allowances. In practice, the EU ETS Innovation Fund allowances are auctioned according to the agreed schedule, and the proceeds are subsequently used to support innovative projects. According to the proposal, the Innovation Fund would be increased by 50 million allowances and by 150 million allowances from the new emissions trading system for road transport and buildings. Additionally, allowances that would otherwise be distributed for free to sectors covered by the Carbon Border Adjustment Mechanism (CBAM) would be auctioned and added to the Innovation Fund.

On the other hand, the Modernization Fund, funded through revenues from the auctioning of EU emission allowances, aims to support ten lower-income EU countries in their transition to climate neutrality by modernizing their electricity sector and overall energy systems, promoting energy efficiency, and facilitating a just transition. According to the EU ETS reform proposal, the Modernization Fund will be increased by auctioning an additional 2.5% of allowances.

Thus, the climate targets for 2030 and 2050 are strengthened by the EU ETS reform, and the message is clear: the market expands, strengthens, and seeks more ambitious goals. The reform of the emissions trading system will continue to provide long-term structural support, although most of the significant program revisions have already been accounted for in the market price.

Juan Carlos Romaní | Head of Energy Markets at Magnus Commodities

If you found it interesting, please share it!

Recent Articles