Groningen is medium-sized town in the north of the Netherlands. As far as towns go, it probably doesn’t qualify as your dream destination but the name is quite famous within the European energy community, for this small municipality is home to the largest gas field in western Europe – a behemoth esteemed at 2800 km3 of gas (imagine a balloon the size of Barcelona or the Everest).

The discovery of the Groningen gas field has been of great importance to the Dutch economy and most of the country’s population (93%) uses gas from this field. Nevertheless, more than 75% of its volume has already been used up and now the country is facing more and more earthquakes, with the community blaming gas extraction. The most recent happened only a few days ago, on May 22nd at 6AM, and is one of the largest ever recorded in the country.

These accusations have led the Dutch government to announce the Field’s closure in coming years. Let’s look at what this means and the impact it can have.

Quick Facts

On May 29, 1959, during a search for oil, the Dutch company NAM (Nederlandse Aardolie Maatschappij BV – now owned by Shell and ExxonMobil) found a huge reserve of gas near Kolham in Midden-Groningen and has been extracting gas from it since 1963. It is now recognized as one of the largest gas fields in the world, with 22 production locations and 258 wells.

Apart from this, the Field contains natural gas with a quality that differs from most other fields in the World. This is because the gas contains a relatively large proportion (14%) of nitrogen in detriment of Methane. This low-calorific natural gas is not what one usually finds in large offshore fields (such as the ones from Norway on the North Sea), but it is ideal for domestic consumption, and is now the de facto standard for gas stoves and boilers in Central Europe.

During the Cold War (until the early 80’s) it was thought that nuclear energy would soon take over the role of gas. Therefore, the consortium deemed a good policy to extract as much as possible as fast as possible. Ergo, most of the extraction actually happened during the 70’s (figure 1). After that, a “small field” policy was put in place, and Groningen became a ‘balance field’. If the demand for gas was higher than what the small fields could supply, Groningen gas was used to meet demand. Due to the lower contribution from the small fields, production from Groningen increased again in the first decade of the 21st century.

Figure 1 – Yearly gas extracted from Groningen field (km3) [Source: NAM]

Blessing or Curse?

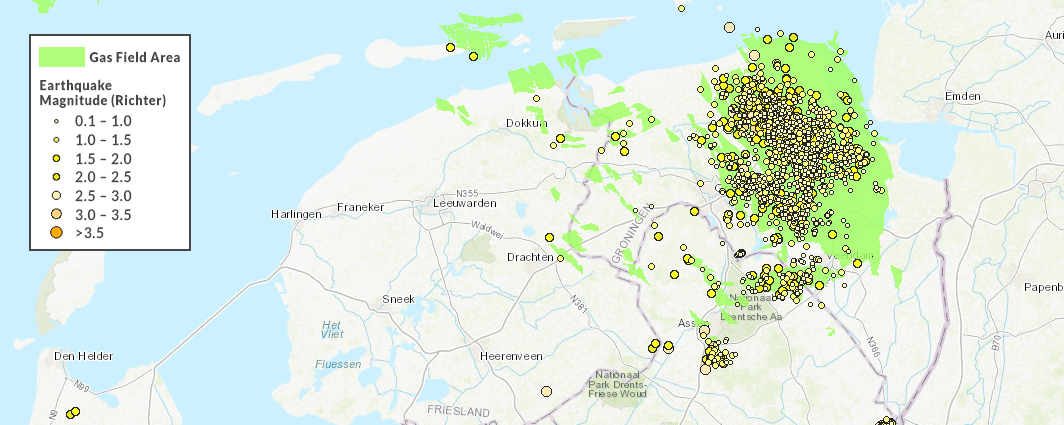

After the massive gas withdrawal of the 70s, the first earthquake as a result of gas extraction was measured. More than a thousand earthquakes have taken place since the 90s. Most of them are light, while others are clearly felt by the population.

The main tipping point for Groningen happened in August 2012 with the 3.6 earthquake of Huizinge – the largest earthquake in the country’s recorded history. The earthquake damaged buildings and infrastructure and, after it, public support dropped dramatically. However, it took 3 years for the Dutch Government to recognize that actions had to be taken, so it was only in 2015 that production restrictions were imposed, allowing for extra capacity only during cold snaps or if necessary.

But, alas, the tremors continued. On January 2018 a 3.4 earthquake hit Zeerijp, the largest earthquake since the one in Huizinge. Following this earthquake, production was again reduced, and the Government presented plans to shut down the Field completely by 2030. Nevertheless, another even larger earthquake just happened last week, near the village of Westerwijtwerd. Luckily there haven’t been many damage claims so far, and apparently no injuries to consider, but it’s soon to understand if this event will speed up Groningen’s closure timetable. In the meantime, NAM is left to deal with thousands upon thousands of damage claims.

Figure 2 – Earthquakes in the Netherlands since 1986. One can clearly observe the concentration around Groningen [Source: NAM]

Turns out that the using of gas revenues for extra governmental spending during the 70’s, led to a strong Dutch currency and very high (subsidized) labour costs, generating a massive financial crisis in the country during the early 80’s. Also, instead of creating a sovereign fund (like Norway), the Dutch continue to use the revenue of gas on their national budget – which means that “fakely” subsidizing social policies with unsustainable cash flows, is still an intermittent trend in Dutch politics. Nowadays, if the country decided to emulate Norway, it would have a 12 billion € (almost 7%!) gap in its budget – which obviously contributes to the definition of the Field’s closure timetable.

The future of Gas

As we keep speculating about the scope and size of the role Gas will play in Europe in years to come, in a moment when almost every government in the EU is talking about shutting down coal and nuclear energy, while renewables fail to rise to the occasion, the closure of Groningen remains a much needed but still serious blow.

Last year, for the first time in its history, the Netherlands became a net importer of natural gas, with importing costs raising 43% YoY to 12 billion €. As trade deficit grows, the Dutch taxpayers will have to support the costs, but one cannot forget that this increase in costs is paired with an equivalent reduction in revenue.

Figure 3 – Dutch Natural Gas Trade Data (Exports/Imports/Difference) in bn€ [Source: CBS.nl]

As the costs of gas rise, it’s likely many domestic and public buildings will convert to electricity, leading to increased demand and the need to create new power plants or increase imports. In fact, imports of low-calorific gas from Belgium, Germany and France are already set to be reduced by 2 km3 per year.

The natural gas market may be somewhat relaxed now but, unless renewables make a huge leap, the multi-year trend appears to go in the opposite direction.

If you found it interesting, please share it!

Recent Articles